Multifractal features of spot rates in the Liquid ...

Transcript of Multifractal features of spot rates in the Liquid ...

Energy Economics 33 (2011) 88–98

Contents lists available at ScienceDirect

Energy Economics

j ourna l homepage: www.e lsev ie r.com/ locate /eneco

Multifractal features of spot rates in the Liquid Petroleum Gas shipping market

Steve Engelen a,⁎, Payam Norouzzadeh b, Wout Dullaert c,d, Bahareh Rahmani b

a Joachim Grieg & Co, 2 Karenslyst Allé, Oslo 0213, Norwayb Christian Albrechts University of Kiel, 40 Olshausenstraβe, Ravensberg 24118, Germanyc Institute of Transport and Maritime Management Antwerp, 24 Keizerstraat, Antwerp 2000, Belgiumd Antwerp Maritime Academy, 6 Noordkasteel Oost, Antwerp 2030, Belgium

⁎ Corresponding author.E-mail address: [email protected] (S. Engele

0140-9883/$ – see front matter © 2010 Elsevier B.V. Adoi:10.1016/j.eneco.2010.05.009

a b s t r a c t

a r t i c l e i n f oArticle history:Received 7 May 2010Accepted 17 May 2010Available online 9 June 2010

JEL classification:C14C32C63Q40

Keywords:MF-DFAR/SLPGFreight ratesHurst exponent

We investigate for the first time the spot rate dynamics of Very Large Gas Carriers (VLGCs) by means ofmultifractal detrended fluctuation analysis (MF-DFA) and rescaled range (R/S) analysis. Both non-parametricmethods allow for a rigorous statistical analysis of the freight process by detecting correlation, scaling andfluctuation behavior regardless of nonlinearity issues. By applying different data-frequencies and a temporalframework, the Hurst exponents indicate that freight rates exhibit trend-reinforcement and persistencesubject to limited time-dependency and controlled volatility. The found long-range dependence corroboratesthat a predictive freightmodel can be built undermining the efficientmarket hypothesis. Memory effects seemto each time build up until they are interrupted by seasonal transitions, stochastic events or cycles which allspark a sudden loss in correlations or increase in nonlinearities. The surrogate and shuffling data proceduresdemonstrate that, dependent on the data-frequency used, memory effects and fat-tail distributions should becontained differently in freight rate models.

n).

ll rights reserved.

© 2010 Elsevier B.V. All rights reserved.

1. Introduction

Shipping is often held up as a volatile and unpredictable market,which is inspired by its derived nature with respect to globaleconomics and trade. In addition come the own characteristics ofthe shipping business such as speculative and herding behavior, andshipbuilding cycles that are compounding its notorious volatility.These effects translate into diffused freight rate processes that at firstsight seem to follow a random walk and difficult to predict.

The realization of the latter conjecture has been one of the reasonsbehind the shift in the maritime literature from building full scalesimulation or econometric models to reduced forms or direct specifica-tions of the freight rate process (Glen, 2006). The aim of scrutinizing thefreight rate dynamics itself is basically to obtain its statistical properties.The benefit of such an exercise is that it supports the valuation (Tvedt,1997) and the efficient pricing (Kavussanos and Alizadeh, 2002) ofshipping assets under uncertainty. Shipping is one of the only industrieshaving an active secondhandmarket where assets are traded. The priceof a ship, like that of every other capital asset, depends on the ship'sexpected future profitability or the investor's expectation on thediscounted cash flows or earnings (Engelen et al., 2006). This corollary

has spawned the use offinancial instruments and techniques that aim tofind the best specification of freight rates.

In this paper we carry out a multifractal detrended fluctuationanalysis (MF-DFA) and rescaled range (R/S) analysis to detect amyriad of correlation properties of LPG spot rate movements for VeryLarge Gas Carriers (VLGCs). Apart from introducing MF-DFA and R/Sinto the area of shipping economics, we investigate the seeminglyundisclosed LPG shipping markets which have hardly been subject toacademic research (Adland et al., 2008). The small size of the LPGmarkets compared to the dry cargo and the tanker markets as well asthe lack of public data are presumably responsible. By researching themultifractal features and temporal correlations of gas freight markets,we are better in the position to assess the predictive ability of freightrate models and the efficient market hypothesis (EMH). Apart fromvaluation and pricing purposes, the specific analysis on gas freightrates could also underpin the pricing of gas freight derivatives orForward Freight Agreements, the use of which is still embryonic butset to grow thanks to expanding LPG markets.

The organization of the paper is as follows. First, we scan the mainfindings and empirical results of previous research on ship marketmodeling. This will not only suggest the main and relevant propertiesof freight rates to be examined but also help reference our correlationresults. As the analysis is done for the industrial LPGmarkets instead ofthe traditional dry and tanker markets, we can check whether marketspecific featureswill prompt different results. Second,we describe and

89S. Engelen et al. / Energy Economics 33 (2011) 88–98

elaborate on the LPG dataset used. Third, we highlight the MF-DFAmethodology and track the origins of multifractality. The R/S methodframes the analysis in a temporal context and deepens the scope of theresults in order to comment on time-dependent behavior, theimportance of data-frequency as well as the repercussions on marketefficiency. The results are contained in the conclusion and providegrounds for further research.

2. Freight market characteristics

In order to better understand the properties of freight rates, it isinvaluable to denote the so-called shipping cycles inherent in themaritime industry (Stopford, 2008). These returning cycles are bornout the time lag between supply and demand adjustments and oftenmagnified by herding behavior. If demand dynamics are buoyant andmarkets undersupplied, freight rates are high propelling shipownersto contract new ships, as everyone is loadedwith cash and attracted bymore fortunes to be earned. Quite often, toomany ships are ordered sothat an overhang of tonnage surfaces a few years later once thenewbuilding are delivered. Freight rates are subsequently correcteduntil the oldest or unprofitable ships are scrapped and marketconditions are restored again. Hence, shipping cycles tell us that highor low freight rates cannot subsist. The consensus is therefore thatfreight rates are mean-reverting in the longer run (Tvedt, 2003) forevery shock in demand can be met in the course of time by the supplyof additional tonnage.

The fact that there are always correcting forces at work does notpreclude freight rates soaring or collapsing during shorter periods. Theparticular shape of the demand and supply function deems in thisrespect explanatory. Demand is in general assumed inelastic withrespect to freight rates as seaborne transport is often the only viableoption to carry the goods. Supply behaves fairly elastic as the fleet ishomogeneous in cost structure (Strandenes and Adland, 2007) until thepoint where ships have to step up productivity and older uneconomicalships need be serviced. If these options have runout and capacity is fullyutilized, the market becomes an auction and freight rates exhibitexplosive behavior. Due to the inelastic demand function, every smallchange in the market balance will in turn impel large adjustments inrates, a phenomenon which is referred to as volatility clustering. Thisbasically means that both small volatilities and large volatilities clustertogether.

As in practice both the rather long-term self-correcting mechan-isms and short-term bifurcations of freight rates conspire, it so provesthat the discussion as to whether spot rates are stationary has notbeen resolved yet. We consent with Strandenes (1984) that in thelong-run freight rates will revert towards long-run equilibrium costsof providing the transportation service. Answering to the issue ofstationarity is hence an empirical question as the time coverage of thesample data used can alter the results (Adland and Cullinane, 2006).Goulielmos (2009) thoroughly reviewed past research and basicallyrejected all nonlinear tests or specifications of freight rates, such asthe use of ARCH and GARCH models (Jing et al., 2008). Not onlynonlinearities but also the rejection of normality based on the Jarque–Bera test, and excess kurtosis and skewness point to the presence ofmemory effects and the misleading nature of ARCH and GARCHmodels with respect to stationarity.

The benefit of MF-DFA and R/S is that both techniques use non-parametric specifications that can better capture time-varyingbehavior. Both methods allow for determining the correlationbehavior of both non-stationary and stationary time series. In addition,all the main nonlinear characteristics of rich datasets such as fat-tailness of probability distributions and volatility clustering arefactored into the concept of MF-DFA and R/S. This is important whentime-dependent correlations are scrutinized to expound on marketefficiency or the design of freight rate models.

For the first time, we apply MF-DFA and R/S on spot rates in theLPG market of VLGC carriers. The above described freight marketcharacteristics are the result of research on the competitive dry cargoand tanker shipping markets. The LPG market has some distinctfeatures: the product LPG is not a raw material (such as e.g. oil, ironore) but is gained by extraction from oil and natural gas wells. As theproduct is literally a by-product, the market is supply-driven and sobehaves as a seller's market confronted with expensive and limitedstorability (the same holds for the electricity markets, see e.g. Higgsand Worthington (2008)). The market is also stigmatized as beingindustrial and therefore less efficient because the players have a long-term operational focus and predominantly use period contracts(namely time charter contracts or Contracts of Affreightments(COAs)). This adds to the fact that the 57 mio ton LPG market ismuch smaller compared to the dry and tanker markets, constitutingaround 3 bio ton in 2008. VLGCs are estimated to have transportedaround 35 mio ton of LPG in 2008, whereof about 15% or 5.25 mio tonon account of spot contracts. It goes without saying that such a smallmarket size induces swifter adjustments in freight rates. Opposed tothis stands that LPG is an energy product used for heating, cookingand feedstock purposes in the petrochemical industry, so thatsubstitutes are available that make seaborne demand more elasticwhich in turn smoothens product prices and freight volatility. Becauseof these unique features of the LPGmarket, it is interesting to see howcorrelations will behave and relate to the results obtained in dry andtank shipping.

3. Data

The time series contains the daily spot rates of VLGCs (80,000 Cbmloading capacity) on the benchmark Persian Gulf (Ras Tanura) to Japan(Chiba) route. Adatabasewas constructedwith rates from03.01.1992 to24.06.2009, sourcing from Lorentzen & Stemoco AS and The BalticExchange. Fig. 1 plots the VLGC spot rates and their daily logarithmicincrements (that is, lnP(t+1)/lnP(t)). Logarithmic returns are used asthey are a convenient way to show daily fluctuations in prices. Alogarithmic approach fits better in the multifractal methods used whilereturns often reduce non-stationarities in time series. As the data-frequency used could potentially influence the results, we haveperformed all calculations for weekly and monthly data too. Thecalculations provide a good additional benchmark to complement andinterpret the daily results.

As Table 1 sets out, the time series consists of 4536 observations, alarge enough set to engage inmultifractal analysis. Adland et al. (2008)used 727weekly observations for the period 1992–2005 and applied anon-parametric Kernel estimator to capture the spot rate process.Anothermajor distinction is thatwe use the spot rates as such,while inAdland et al. (2008) the time charter equivalent (TCE) spot rate wasused. The latter is a calculated freight figure and obtained aftersubtracting voyage costs from spot rates. We prefer spot rate analysisas this is the relevant price contracted on the market and the basis forpricing derivative contracts and many COAs. Moreover, TCE earningscorrect for the less deterministic voyage costs (predominantly thebunker cost dynamics), which are governed by oil prices. We considerit valuable to integrate bunker dynamics in the analysis as it shapes thefreight rate process as such.

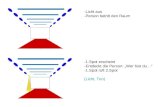

As charted in Fig. 2, the price increments are skewed to the rightside showing excess kurtosis. The probability distribution function(PDF) of increments also shows a high degree of peakedness andrather fat tails, bearing out a clear departure from Gaussian normalityand implicating that prices are subject to stochastic events. Indeed,the LPGmarket usually suffers from overcapacity and freight rates arebounded from below due to minimum service costs. Strong freightmomentum is often short-lived and instigated by a temporary spike inMiddle East exports. The empirical cumulative distribution curvesupports the rejection of normality as the curve is clearly nonlinear. As

Fig. 1. VLGC spot rates ($/ton) and price increments.

90 S. Engelen et al. / Energy Economics 33 (2011) 88–98

in Adland et al. (2008), we obtain the same result by the Jarque–Berastatistic in Table 1.

Zooming in on seasonality patterns can also yield interestinginsight into the structure of freight rate processes as Kavussanos andAlizadeh (2001) pointed out. Fig. 3 highlights that freight rates tend toincrease through the year in line with increased ship demand toreplenish stocks in the period August–October until colder weathereffectively kicks in and LPG deems too expensive. Stocks are used inthe winter to satisfy the increased LPG consumption for heating,coinciding with less transport requirements and in turn a decline inrates. It is interesting to note that seasonality patterns especiallystrengthened during the last 5 years with LPGmarkets expanding. Wewere not able to derive obvious seasonal spikes from the traditionaldaily, weekly or monthly autocorrelation function (assuming Gauss-ian properties) that rather point to a slow price returns´ decay in time,hence, the amplitude of returns or volatility clustering.

For the sake of completeness, it is evidenced from Fig. 4 that dailygas returns are stationary as the standard deviation gets alreadysaturated after an average time length of 20 observations. Hence,nonlinearities or volatility clustering would mainly surface in the veryshort run. The stationarity result, formally tested in Appendix A, is animportant information not only to better understand and denote thecorrelation behavior in the next sections but also to compare gas toother shipping markets. Stationarity, although not a necessary

Table 1Descriptive statistics daily VLGC spot rates.

Database Log returns

Observations 4536 4535Mean ($/ton) 30.91 −6.798 e−005Maximum ($/ton) 81.64 0.1105Minimum ($/ton) 12.90 −0.1440Std. deviation 11.05 0.0166Skewness 1.13 −0.0498Kurtosis 1.64 8.6984Jarque-Bera 1478 14295

condition, also adds to the reliability of the results obtained by R/S(North and Halliwel, 1994).

In line with general freight market characteristics, the dataanalysis of gas returns has demonstrated that we need to applymethods such as MF-DFA or R/S that can accommodate the adverse ornonlinear effects from volatility clustering, non-normality or fat tails.

4. MF-DFA methodology

MF-DFA is a generalization of the Detrended Fluctuation Analysis(DFA), which is a scaling analyzing technique providing a simplequantitative parameter – the scaling exponent α – to represent thecorrelation properties of a time series. Unlike DFAwhich is only using thesecond moment, MF-DFA widens the scope to q-order momentsdepending on the time series length. Instead of one scaling exponent(monofractals), MF-DFA derives a continuous set of scaling exponentsreferred toas the singular spectrum.Thebenefit ofMF-DFA ishence that itscaleswithmultiple rules allowing for amore rigorous analysis of thedata(Peng et al., 1994). In order to extract and reliably detect correlations,multifractal analysis among other things distinguishes trends fromfluctuations at the same time that it can retrieve their origin and shape.Another benefit of scaling behavior tools is that one is able to deduct long-range correlations based on high-frequency data as the calculations areextrapolated across different time scales. This benefit will be checked byperforming the analysis for different data-frequencies.

For there is a close link between the interpretation of the resultsand the MF-DFA methodology, we briefly describe the method usedand refer to Kantelhardt et al. (2002) for more detail. The MF-DFAprocedure is basically a five-step algorithm, the first three of whichare identical to the conventional DFA procedure.

1. A profile y(k) of the time series xk is created with k=1…N and x–

representing the average value.

y kð Þ = ∑k

i=1x ið Þ− x–h i

ð1Þ

Fig. 2. Comparison of the empirical/fitted normal histogram of price returns (left) and the empirical/Gaussian cumulative distribution function of price increments (right).

91S. Engelen et al. / Energy Economics 33 (2011) 88–98

2. The profile is divided into ns non-overlapping boxes of equallengths s with ns≡floor (N/s). In order not to disregard some datapoints to be left out, the procedure is repeated starting from theopposite end of the dataset.

3. In each box, the time series is fitted by using a local polynomialtrend yv of order v. The corresponding variance of original versusfitted data is given by:

F2 v; sð Þ = 1s∑s

i=1fy N− v−nsð Þs + i½ �−yv ið Þg2 ð2Þ

with v=1…ns. To obtain a DFA of order v, the v-order polynomialfunction should be used, detrending the profile in each box in adifferent manner. DFA1, DFA2 or DFA3 point to the use ofrespectively a polynomial fit by a linear, a quadratic or a cubicfunction.

4. The qth order fluctuation function is obtained by averaging over allboxes. For q=2, the standard DFA is retrieved. The index q can takeany real value except zero.

Fq sð Þ = 12ns

∑2ns

i=1F2 v; sð Þq=2

" #1=q

ð3Þ

5. By repeating step 3 for various time scales s, the relation betweenthe fluctuation functions Fq(s) and time scale s can be studied fromthe slope of the so-called log–log plot. The scaling behavior of Fq(s)

Fig. 3. Seasonality in VLGC spot rates.

is then determined for each q. If the original time series xk arepower-law correlated, Fq(s) will increase for large values of s, as apower-law:

Fq sð Þ∼sh qð Þ ð4Þ

The family of exponents h(q) describes the scaling of the qth orderfluctuation function. For positive values of q, h(q) describes thecorrelation behavior of segments with large variance F2(v,s) orfluctuations. This is explained by the dominant impact of e.g. positiveq's and large variance segments on the average Fq(s). Analogously fornegative values of q, h(q) describes the scaling behavior of segmentswith small fluctuations. For stationary time series, the exponent h(2)is identical to the Hurst exponent. The family of exponents h(q) isreferred to as the generalized Hurst exponents. It is interesting to notethe richer specification in Eq. (4) than the DFA power-law relation F(s)∼sα. In monofractal series h(q) is independent of q as a singleexponent is used. A typical characteristic for multifractal time series isthat h(q) varies with q. It can be shown (SadeghMovahed et al., 2006)that the h(q) obtained from MF-DFA are related to the classicalmultifractal Renyi exponent τ(q) by:

τ qð Þ = qh qð Þ−1 ð5Þ

Fig. 4. Standard deviation price returns σ versus box size s.

92 S. Engelen et al. / Energy Economics 33 (2011) 88–98

Another way to characterize multifractal series is hence thesingularity spectrum f(α), that is related to τ(q) via a Legendretransform (Feder, 1988). With α=τ′(q), standing for the derivative ofτ(q) with respect to q, we become:

α = h qð Þ + qh′ qð Þ and f αð Þ = q α−hðqÞ½ � + 1 ð6Þ

Hereby, α is the Hölder exponent or singularity strength denotingthe singularities in a time series ormonofractility. Singularity basicallypoints at the rapid changes in the time series values for small changesin time. In the multifractal case, the different parts of the dataset arecharacterized by different values of α, or the singularity spectrum f(α).

It is important to underline thedifference between theabove conceptsas theywill beused in theanalysis of retrievingmultifractal featuresof ourdataset.Moreover,wewill deepen the analysis by extracting the source orthe origin of multifractality. In general, two types of multifractality exist:the first is due to different long-range temporal correlations or memoryeffects for small and large fluctuations. The second is due to fat-tailedprobability distributions of variations (broadness of the PDF). Both typesrequire a multitude of scaling exponents in order to fully describe thecorrelation behavior and to assess the true nature of the correlations. Twoprocedureswill beapplied tomeasure the contributionsof both sourcesofmultifractality. The shuffling procedure preserves the distribution of thevariations but destroys any temporal correlations. The dataset becomesthen a Markov process but with exactly the same fluctuation distribu-tions. Surrogate data are used to detect the contribution of the fat-tailedincrements onmultifractality.Wewill use phase-randomized surrogates,thereby relaxing the non-normality of the distributions which wasproposed by Theiler et al. (1992) to discover nonlinearities in time series.Phase randomization preserves the amplitudes of the Fourier transformbut randomizes the Fourier phases. This procedure eliminates nonlinea-rities and holds the linear properties of the original time series (Panter,1965). We will show and explain how the generalized Hurst exponentscan be used to retrieve the type of multifractality.

5. MF-DFA-results

Following the steps of theMF-DFAprocedure for the VLGC spot rateincrements, we start by depicting Eq. (4) or the relation between Fq(s)and s for several moments of q in Fig. 5. The log–log plot demonstratesthe fractal dimension or power-law for q=−10 to q=10 signalingthat the data are scale-invariant or fractal.

As the time scale s gets larger, it shows that the behavior of the timeseries fluctuations for different values of q evolves to the same Fq(s). Infact there is a time scale large enough at which, regardless of the valueof q, the same variance is reached for both small and large fluctuations.If a small box scale is used, the behavior of small and large fluctuations

Fig. 5. Fluctuation functions Fq(s) versus box size log(s) for q=−10 to 10.

is different. By zooming in on the log–log plot, the benefit of usingseveral fluctuation functions is that several scaling regimes or regionswith uniform scaling can be distinguished (Uritskaya and Serletis,2008). A crossover-point or a sudden change in the slope of thefluctuation function (=visual representation of the scaling exponent)marks a change in regime.

– A first strong memory regime that can be detected lasts around 4trading days (s=2) given by the steep slope of the fluctuationfunction. The reason behind the strong presence of memory effectsis probably the formation of spot rates itself. Everyday a brokerpanel consisting of 8 shipping companies postulate an estimationof the spot rate, which is then averaged into the Baltic Gas Index.As there are not enough spot transactions, quite often the ratefrom the previous day is repeated with a minor or otherwise asignificant adjustment. It is mostly on Friday that shipbrokersreally assess the market balance and freight rates when they sendout their weekly reports. This explains that in the very short runspot rate increments display dominant persistent behavior.

– A second scaling regime goes from s=2 to s=6 that translatesinto 60 trading days, ca. 84 days or approximately a season.Seasonality in the gas markets is well-known but not to the extentit would really impact on freight rates.

– A third scaling regime surfaces in the period s=6 to s=8encompassing 192 trading days, ca. 269 days or three seasons. Acheck of the time series shows that this period often coincideswith acycle inwhich rateshave increasedanddecreased again. Such a cyclecomprises e.g. the start of the spring to thewinter encapsulating thesurge and fall in rates during the summer period.

The log–log plot is often useful to visually retrieve a specific trendin the increments. In our case, apart from the strong very short runscaling regime that is inspired by the freight rate stipulation process,there is no clear trend that emerges. Or, there are enough trendfunctions that could be used to mimic the behavior of the freight ratefluctuations. Adland et al. (2008) conclude via a Kernel approach thatthe weekly VLGC freight rates can be approximated by a linear model.Our analysis confirms indeed that this can be used, but does notuniquely retain this as the only viable trend to describe the consideredfreight rate process.

The above results make it redundant to estimate the Hurstexponents and apply a straight line regression based on Eq. (4) foreach value of q. In the literature (Peng et al., 1994), both h(q=1) and h(q=2) are used to denote the Hurst exponentH. The fitted linear Hurstexponentof 0.67 reveals that the freight rate process is correlatedor thata price increase in the past ismore likely to be followed by an additionalprice increase than a price decrease. Hence, daily spot rate movementsare persistent (h(q)N0.5) and subject to trends. The Hurst exponent canalso be interpreted as ameasure of the bias in the standard or fractionalBrownian motion H=h(q=2)−1. Hence, the deviation from therandomwalk provides interesting information on the volatility and riskinherent in shipping. A relatively high Hurst exponent underpins therelatively smooth trend and less or controlled volatility. As pointedearlier, for positive values of q, h(q) especially describes the segmentswith large variance or fluctuations. These observations indicate that thetrending process is dominant in periods where rates are increasing ordecreasing for a period of time. This persistent effect is stronger than themean-reversion or anti-correlation (h(q)b0.5) process of spot ratemovements.

The above elements have important economic repercussions onmarket efficiency and forecasting power of models. Higher Hurstexponents point to developing markets or markets in which the EMHdoes not hold. The EMH, bluntly stated, postulates that in competitivemarkets all information is instantaneously reflected in prices and it isnot possible to structurally beat the market. The consequence is thatprices should follow a random walk (h(q)=0.5) and markets cannotbe predicted. The larger h(q) deviates from 0.5, the less noise in the

Fig. 6. Comparison of scaling exponents h(q) and τ(q) for original and randomized price increments.

93S. Engelen et al. / Energy Economics 33 (2011) 88–98

system or the more time series are (anti-) correlated so that thepredictive ability of models rises too. As Adland et al. (2008) also find,gas freight rates can be specified by a relatively easy model:integrating the above seasonal and cyclical effects should suffice toobtain e.g. a forecastable model. The ability to have a model at handhowever shifts the question as to whether the market can actually beexploited as such. This question can better be answered if the originsof multifractality are examined and the EMH is put in a temporalcontext.

Instead of using one Hurst exponent or measure of correlations,the analysis can be enriched by applying the different multifractalscaling exponents visualized in Figs. 6 and 7. The strong dependencefor the original dataset between h(q) compared to q surfaces that theprice increments are scale-invariant. The strong measure of multi-fractality is revealed by the broad range of Hurst exponents, i.e. thedifference between maximum and minimum values. Monofractaltime series are associated with a linear τ(q) plot, while multifractalseries expose spectra nonlinear in q. The higher the nonlinearity inspectrums, the stronger the time series are multifractal. The steepslope in the τ(q) plot in this respect confirms the presence ofmultifractality especially in the small variance segments with qb0.Another signal of multifractality is demonstrated by the curvature inthe singularity spectrum f(α) versus α. Both the broad spectrum of f(α) and the rapid modified values of the Hölder exponent underlinethe richness of our dataset.

Apart from underlining the complexity of the dataset, the value inthese figures is especially in its ability to track the origin of fractilityand the true nature of the correlation results. Both the h(q) and the

Fig. 7. Origins of the singularity spectrum

τ(q) plot indicate that the multifractal nature of the price incrementsis mainly due to memory effects rather than a fat tail, given by thewider departure of the shuffled data from the original dataset. Thisholds both for the small and large variance regimes with respectivelyqb0 and qN0. As stated earlier, this is among other things inspired bythe manner in which freight rates are often marginally adjusted everyday. When freight markets are in the doldrums with significantovercapacity – something which frequently occurs in the industrialgas market – the bunker costs often determine the lower bound of thefreight rate. Spot rates remain dull and hardly move as brokers haveno other grounds to quote other rates. This result in a strong memoryeffect and explains why shuffling the time series has a strong bearingespecially in regimes with qb0. In large variance segments or regimeswhere freight ratesmove in large steps, the effect might be less simplybecause of the reduced frequency of freight markets being tight orbuoyant. The surrogate curve in the h(q) and τ(q) panel is almostlinear, strongly pointing to monofractality. The surrogate procedurehence tells that nonlinearities are present in both the low and highvariance segments.

It is generally acknowledged that the singularity spectrumprovides the most detailed test to represent the complexity and thetypes of multifractality. The reduced curvature of the daily shuffled(and surrogate) price increments clearly point that memory effectsare present as the singularity strength f(α) of the higher values for theHölder exponent α is destroyed. It is interesting that especially for thehigher values of the Hölder exponent, characterized as regions withmore regularity, the correlations of the increments are destroyed byshuffling. For data behaving more singularly or irregularly, the

for daily and weekly price returns.

Table 2Evolution time-dependent Hurst exponent h(t) by box size and data-frequency.

Box size Daily Box size Weekly Box size Monthly

16 0.7932 0.7964 0.79 13 0.68128 0.77 26 0.67192 0.76 39 0.68256 0.76 52 0.68 12 0.67512 0.72 104 0.63 24 0.581024 0.69 208 0.59 48 0.532048 0.65 416 0.53 96 0.48Total Total TotalR/S 0.62 R/S 0.51 R/S 0.43MF-DFA 0.67 MF-DFA 0.52 MF-DFA 0.44

94 S. Engelen et al. / Energy Economics 33 (2011) 88–98

correlations seem to persist. Againwe dowitness that the randomizedsurrogates lead to a monofractal series and the removal of allnonlinearities. The small width of the fractal even resembles that ofa Brownian motion. Nonlinearity and fat tails hence have to beintegrated in freight rate models.

The above findings are all characteristics of our daily priceincrements. Quite often, although freight rates are quoted every day,instead of daily observations weekly or monthly time series are usedfor research to correct for the dominant short-term memory effects. Ifthe complete exercise is redone for weekly and monthly freightmovements, some interesting conclusions surfaced. By using weeklyobservations Fig. 7 in this respect shows that the time series do nottruly have a memory process in place but are independent. Fat tailsand nonlinearities however will still be present in almost the samefashion as with daily analysis. If monthly observations are used, it isstriking that both the shuffling and surrogate procedure demonstratethat memory effects and fat tails disappear. Changing the frequency ofthe dataset will hence significantly alter the time series character-istics. This is also corroborated by the different Hurst exponentsobtained for weekly and monthly increments. The weekly andmonthly generalized Hurst exponents are then respectively 0.52 and0.44 pointing in turn to a random walk or mean-reversion. By usingweekly spot earnings for a smaller dataset, Adland et al. (2008)advances strong support of mean-reversion, thereby rejecting thehypothesis that the price process is a Martingale (zero drift) atstandard confidence levels at either end of the observed range ofearnings. For the sake of completeness we compare the obtainedresults with Goulielmos (2009) who calculated the Hurst exponentsof Aframax tanker (80–120,000 deadweight ton capacity) freight ratesfrom 292 monthly observations during 1984–2008. By so doing, aHurst exponent of 0.64 was found exhibiting persistence or trend-reinforcement. As we detected mean-reversion for monthly gas rates,it so proves that apart from data-frequency, market specificcharacteristics interplay that preclude generalizing our findings tothe other shipping markets. The obtained results will deem veryuseful when contemplating the time series in more detail in the nextsection.

6. R/S analysis

The multifractal analysis thus far has mainly focused on the entiredataset. As highlighted in Section 2, however, many short-term, long-term or seasonal forces in shippingmarkets interplay at the same timeleading to complex and time-varying freight rate processes. Uritskayaand Serletis (2008) therefore recommend to zoom in on a thedynamics of the scaling exponents by quantifying them in a time-dependent context as the Hurst exponent is a sensitive indicator tochanging conditions or time. One method that can recalculate theHurst exponent in temporal fashion is the traditional R/S method (seeEdgar (1996) for a thorough overview) that in addition allows for arelatively easy scan of the results obtained thus far. Despite the knowndrawbacks (bias in estimating Hurst exponent, discontinuous boxcounting), the R/S technique is still widely applied, especially whenthe price returns are stationary rendering the results more reliable(North and Halliwel, 1994). The calculation can be summarized as:

R.

SNð Þ = 1

σNmax1≤i≤N

∑N

i=1x ið Þ− x–

� �" #− min

1≤i≤N∑N

i=1x ið Þ− x–

� �" #( )ð10Þ

In this classical compact form, σN refers to the sample standarddeviationwith equal box sizeN, while thefirst and the second terms onthe right hand side refer respectively to the maximum and theminimum of the partial sums of the first i deviations of x(i) from thesample mean. Mandelbrot and Wallis (1969) highlighted the rele-vance of R/S with respect to detecting memory effects and scaling

behavior, advancing the following power-law relation (analogous toEq. (4)) to hold for a sufficiently large size of N:

R.

SNð Þ∼NH ð11Þ

BycomputingEqs. (10)and(11), theR/Sanalysis yields approximatelythe same Hurst exponents as MF-DFA for the entire sample as Table 2corroborates. It is interesting to proceed to the calculation of the time-dependent Hurst exponent h(t) to better denote these general outcomesand to smoothen the effect from outliers. Instead of just providing onenumber to characterize the global properties of time series, the scalingexponent or correlation behavior is put in a progressing time windowallowing for tracking the time-variability of the Hurst exponent. In thecase of a timewindow of 1024, the window starts progressing after 1024observations and returns 4534–1024 or 3510 Hurst exponents. Themethod is described in Peng et al. (1994), and applied in e.g. Alvarez-Ramirez and Escarela-Perez (2010) using a seven-day rolling window. InTable 2, we have used several window lengths to account for the effect ofdifferent time scales and to better follow the evolutionary path or stabilityof h(t). The selection of exactly 16, 32,…, 2048 observations is inspired bythe technical details of the R/S method. Using these daily box sizes, thetime series need not be broken into smaller blocks as e.g. 1024 or 210 is aninteger multiple of 2. The results clearly confirm the persistent memoryeffects. Comparing a box size of 16 to 1024 e.g., it is remarkable that h(t)only decreases with about 0.1, pointing to long-range dependence offreight rate movements. Also when weekly or monthly time scales areused can we notice that positive correlations are dominant on smallerscales, only to temper slowly as time increases. The tabulated exponentshence show the relativity of using one single exponent to characterizetime series.

In the next step, we confronted h(t) across time scales with the actualfreight rates and freight rate movements to thoroughly check howdeviations and correlations behave over time. Themain focus was on thedaily results as these form the richest dataset at the same time that theystill allow to filter long-range dependence. The analysis reveals thatinteresting results could be derived from the daily correlations stretchedover one (256 trading days) or two (512 trading days) years. Takingaccount of the progressing time window, the plotted h(t) in Fig. 8 movesstrikingly well in concert with the freight rates in Fig. 1. This congruenceamong other things demonstrates how shipping cycles can be recoveredover time. A first cycle is detected from 1993/1994 lasting to 1996/1997with correlations increasing through the cycle to subsequently reduceand disappear as the cycle ends or another cycle emerges. A second cycleshapes through 1998 to 2003: starting in 1998, the top reaches in 2001and the collapse follows in 2002. The third cycle begins end 2003 andslowly progresses to reach the climax in the summer of 2008 when therates were all-time high after which the market crashed over night,articulated by a steep reduction in h(t). It is especially sudden marketchanges, exogenous effects (e.g. Asia crisis) or shipping cycles ending (e.g

95S. Engelen et al. / Energy Economics 33 (2011) 88–98

profilerationof overcapacity) that arewell capturedbya significant loss inmemory effects or the reduced Hurst exponents. As in Alvarez-Ramirezand Escarela-Perez (2010), we also witness that such phenomena triggernonlinearities and abrupt price changes that induce a fall in correlations.During cyclesorperiodof timeswithnostochastic transitions correlationsseem to build up and persist over time. This underpins the results fromFigs. 6 and 7, in which memory effects were most important in periodswith low variance or more regularity. Likewise results can be derivedfrom the weekly h(t) over 52 trading weeks, although the pattern is lesspronounced than with daily fluctuations.

By using a smaller semi-annual box size in Fig. 9 variations withinyears can be investigated. The same cyclical indications (underlined inFig. 9) can be retrieved as in the case of annual cycles, reflected by thesudden decline in h(t). In addition, other moments can be spotted atwhich correlations swiftly tumble. A closer look on these effects showthese events can be inspired by different forces. One reason can be cyclesthat do not fully materialize. As Stopford (2008) describes, history hasshown that a full shipping cycle typically consists of 4 phases – trough,recovery, peak, collapse – some ofwhich do not alwaysmaterialize due tostochastic events such as canal closures, wars etc. that strongly affectdemand and supply fundamentals. The market has to be rebalancedbefore the cycle continues or a new cycle emerges. It is hence difficult toassess whether freight rates fall precipitately or refind equilibrium. Thisclearly happened in the period 1998–2004 in which the market wasseveral times on the verge of collapsing before it really did. What can belearned from these observations is that uncertainty or a lack of marketbalance leads tomore nonlinearities or secular price behavior that in turntranslate into reductions in h(t).

Another force at work are the seasonal variations that return. Bymirroring Figs. 9 and 10 to freight fluctuations, it seems the seasonalpatterns are a recurrent theme although it does not easily show fromthe correlations. This can be due to the dominance of random events,or arbitrage in the product market that quickly causes ships to berepositioned with repercussions on freight rates. Another moreimportant factor to consider is that market participants alreadyanticipate the stockbuilding period of August–October and winterspell. Seaborne gas transport is a derived product from LPG demandand supply, markets in which traders heavily try to reap the benefitsfrom exploiting markets in contango (stockbuilding) and back-wardation (winter). This is probably why we often do not see a shiftin scaling behavior in the seasons itself but more when the transitionsfrom one season to another take place. The bias or the deviation fromthe random walk is hence generated by the market participants whoreact and anticipate seasonality. Especially in November andMarch dowe locate a loss in correlations or increased nonlinearities. Novembermarks the month in which stocks have been replenished andoccasional winter transport requirements are to be determined. Thelatter involves speculation about winter spell as e.g. cold weather in

Fig. 8. Daily h(t) for box sizes of

January in Japan needs be anticipated by a Middle East-Japan voyagethat takes around 36 days. A likewise regime switch occurs in Marchwhen the market is coming out of the winter and usual tradingpatterns are restored. The previous results can hence be confirmedthat markets in lack of information or transition are characterized by adecrease in h(t). These recurrent changes could be accommodated bya regime-switching model as proposed in Huisman and Mahieu(2003) or Higgs and Worthington (2008).

The results from the more detailed box size analysis allow tofurther add to the general results obtained by MF-DFA and R/S. It isstriking that both for the large and the small time scales the memoryeffects are persistent at the same time that they are subject to limitedtime-dependency. The daily h(t) in Figs. 8–10 never seem to reverse toanti-cyclical movements or a random walk. The fact that thisresonates to larger periods corroborates long-range dependence. If ageneral approach is desired, it shows that for a box size of 1024observations or approximately 4 years h(t) oscillates between ca.0.64–0.74 supporting the controlled and smooth volatility of freightrate increments or limited time-dependency. A side note in thisrespect is that across the bigger time windows we could not find anobvious relation between the rather stable persistence of the Hurstexponent and volatility, measured by the standard deviation of theprice returns. Annual cycles or longer periods with higher or lowervolatilities would hence have no marked impact on memory effectscontained in the freight increments. This absence of time-varyingbehavior supports that parametric forms can be used to describeglobal freight rate patterns, which is in line with the findings ofAdland et al. (2008).

7. Market efficiency

Summarizing the results throughout this paper, the scaling andmultifractal results validate that freight rate forecasting is a feasibletask because of returning phenomena of cycles (3–4 years) or long-range dependence and a lack of time-variability (in volatilities andcorrelations) over longer periods. The trend-reinforcing behavior infreight rate movements is dominant and only abruptly halts by astochastic event or a changing regime (e.g. seasonal transition) thatinterrupts the ongoing cycle. Nonlinearities therefore are often short-lived and explain the presence of fat tails, the loss in memory or valueof the Hurst exponent. The speculative and anticipative behavior ofmarket participants in itself creates a bias or noise that causes h(t) tosecularly deviate from a random walk.

From a theoretical point of view, there are hence some elements thatinterfere with efficient markets. The strongest argument is given by thesteep very short run scaling regime in the log–log plot that underpins avery high Hurst exponent. Wang et al. (2010) in addition argue that thedifferent results across fluctuation functions also affirm market

256 and 512 trading days.

Fig. 9. Daily h(t) for box size of 128 trading days.

Fig. 10. Daily h(t) for box size of 64 trading days.

96 S. Engelen et al. / Energy Economics 33 (2011) 88–98

inefficiency. Daily, weekly and even monthly analysis confirmed thepersistent behavior over several years. The fact that h(t) is generally notdecreasing over timemeans that the gas markets have not becomemoreefficient but remained in their developing stadium. FollowingWang et al.(2010) on h(t) regimes, gas freight returns rarely approach a randomwalk or switch tomean-reversion (only inweekly andmonthly temporalanalysis) questioning efficient market functioning. The question thenshifts as towhethermarket participants can exploit these inefficiencies inpractice.

LPG traders already try to exploit seasonality in energy markets byselling and buying LPG at the right moment. It seems shipowners andcharterers coulddo the same thingbybeingshort or long in tonnageat theright moment, especially in periods of seasonal transitions that introducea new scaling regime. The only difficulty that remains is that VLGCshippingmarkets lack liquidity. Although spot rates are quoted on a dailybasis, quite often there are only a few spot transactions done per month.This renders it tedious to exploit the strong persistence in the very shortrun, and also feeds the discussion as to whether the VLGC market reallyneeds daily freight quotations. As the positive correlations stretch outover annual cycles irrespective of the data-frequency applied, there isevidence thatmarkets can technicallybebeatenby strategicbehavior. Thefact that the freight service is non-storable and that freight contracts areeasily transferable to other charterers or shipowners add to this.

8. Concluding remarks

In this paper amultifractal approach is applied to analyze VLGC freightrates. In line with maritime theory, spot rate changes demonstratepositive skewness and excess kurtosis. It is in this respect welcome thatMF-DFA and R/S can deal with nonlinearities inspired by non-normality,fat tails, volatility clustering and seasonality. MF-DFA in addition usesmultiple scaling rules and detrends the dataset to overcome short-termnon-stationarities. The strong evidence of stationarity for theprice returns

adds to the reliability of the R/S results, exacerbated by the fact that theresults are analogous to those obtained by MF-DFA. In order to correctlyinterpret the results and derive conclusions, the correlation analysis wasthoroughly put in a temporal context with varying data-frequency (daily,weekly or monthly observations) and time scales to distinguish betweenshort and long-run time series behavior.

The different approaches used clearly indicated multifractal featuresof the freight rate process inspired by memory effects and fat-tailedbehavior, the latter of which significantly behave differently when thedata-frequency is changed. The different multifractal exponents and thesingularity spectrum show that by using weekly observations thememory effects disappear while monthly returns would in addition alsodelete the fat tails and render the time series monofractal. The selecteddata-frequency hence affects the type of model (e.g. linear or not) thatshould be used to specify freight rates. We mainly focused on the dailyobservations as this forms the richest dataset at the same time that it wasevidenced that MF-DFA or R/S are then still able to display long-rangedependence and return the best results. Market specific characteristicsthereby prompt different correlation results than those obtained fromanalysis of other shipping markets.

For the entire sample, the daily Hurst exponent of 0.67 varyingbetween 0.61 and 0.71 indicates that freight rate movements exhibitsmooth trend behavior and persistence, underlining the controlledvolatility and memory present in the time series. Moreover, there seemto be no obvious relation between the persistence of the Hurst exponentand standard deviation or volatility over time. The absence of strong time-dependent behavior facilitates the use of parametric functional forms todescribe freight rate processes.

In the very short run, the log–log plot clearly visualized that thememory effects of freight rate increments are artificially high due to thenatureof the freight rate stipulationprocess and the lackof correspondingtransactions in practice. From the time-dependent quantification of theHurst exponent, it appears that correlations are trend-reinforcing over

Table 3Unit root test results VLGC spot rates.

ADF (lags) Phillips–Perron KPSS

Constant Constant+trend Constant Constant+trend Constant Constant+trend

Test statisticPrices −4.09 −4.39 −4.067 −4.366 1.860 0.109Price returns −25.985 −25.983 −40.574 −40.570 0.025 0.0211

Critical values1% −3.431 −3.960 −3.431 −3.960 0.739 0.2165% −2.861 −3.410 −2.861 −3.410 0.463 0.14610% −2.567 −3.127 −2.567 −3.127 0.347 0.119

MacKinnon (1996) one sided critical values for ADF and PP.KPSS table (1992) for critical values.

97S. Engelen et al. / Energy Economics 33 (2011) 88–98

longer periods even resonating over several years or annual cycles. Thereis a clear tendency of positive correlations over time that are interruptedby seasonal market transitions, stochastic events or the end of theshipping cycle (overcapacity and subsequent fall in rates) emerging. Thisis each time reflected by a sudden loss in the value of the correlationexponents or by increased nonlinearities popping up, after which a newregime of memory effects is built up again.

The strong persistent behavior in the freight rate process withhardly any switch to a random walk or mean-reversion process areelements that add to the capacity to build a forecast model and as suchinterfere with the EMH. A lack of liquidity in the VLGCmarket rendersit difficult to exploit inefficiencies in the short run while shipownersand charterers could potentially benefit in the longer run bystrategically positioning themselves being short or long in tonnage.

The above findings pinpoint that short-term and long-term effectsconspire and thatmultiscaling features shouldbe takenup in freight ratemodels. In order to fully capture the short-term effects, specific types ofautoregressive (see e.g. Bowden and Payne, 2008) or fractionalBrownian motion models could be designed but likely not withoutintroducing concepts from jump processes to account for sudden largediscrete movements. Ideally, a functional form needs to be developedthat also encapsulates the long-term mean-reversion characteristicsinspired by cycles. The building of a tailor-made error correction modelor a mean-reverting/regime-switching model (see e.g. Huisman andMahieu, 2003; Higgs and Worthington, 2008) are in this respectinteresting avenues for further research. It would not only allow tobetter specify LPG spot rate processes and develop a derivatives formulabut so too would it help assess the asset values of gas carriers and caterfor profitable investment strategies.

Appendix A. Stationary test

As set out in the introduction, it is not easy to determine as towhether time series are stationary due to issues of sample size ordata-frequency. Several formal tests are commonly used in practice.The traditional augmented Dickey Fuller (ADF) test is a unit root testwith the null hypothesis claiming that the series is non-stationary. Inline with the literature, the test is performed for both the intercept(constant), and intercept with trend. The lag length is automaticallycomputed based on the minimization of the Schwarz informationcriterion. The Phillips and Perron (PP) test is comparable to the ADFtest but makes a non-parametric correction to the t-test statistic tocapture the effect of autocorrelation present when the underlyingautocorrelation process is not AR(1) and the error terms are nothomoscedastic. The null hypothesis of the KPSS test developed byKwiatkowski et al. (1992) investigates whether the time series arestationary around a deterministic trend. The ADF and PP results inTable 3 clearly point to stationary freight rates and their returns. TheKPSS test yields mixed results for the original freight rates, as the testwith constant term rejects stationarity for all considered confidencelevels. A closer look on the test reveals that the outcome is dependent

on the bandwidth selection method chosen, which is, bluntly stated,important to determine the weight of the time lags used in theestimation. If the parametric Andrews (1991) test is used instead ofthe conventional non-parametric Newey and West (1994) test, theKPSS test results remain inconclusive: stationarity would then beconfirmed for the constant version, while rejected for the constantwith trend version for all confidence levels. The most importantconclusion is that all three tests unambiguously support stationarityfor the freight rate returns.

References

Adland, R., Cullinane, K., 2006. The non-linear dynamics of spot freight rates in tankermarkets. Transportation Research Part E: Logistics and Transportation Review 42(3), 211–224.

Adland, R., Haiying, J., Lua, J., 2008. Price dynamics in the market for liquid petroleumgas transport. Energy Economics 30 (3), 818–828.

Alvarez-Ramirez, J., Escarela-Perez, R., 2010. Time-dependent correlations in electricitymarkets. Energy Economics 32 (2), 269–277.

Andrews, D.W.K., 1991. Heteroskedasticity and autocorrelation consistent covariancematrix estimation. Econometrica 59 (3), 817–858.

Bowden, N., Payne, J.E., 2008. Short term forecasting of electricity prices for MISO hubs:evidence from ARIMA-EGARCH models. Energy Economics 30 (8), 3186–3197.

Edgar, E.P., 1996. Chaos and order in the capital markets: a new view of cycles, prices,and market volatility. John Wiley and Sons, New York.

Engelen, S., Meersman, H., Van de Voorde, E., 2006. Using system dynamics in maritimeeconomics: an endogenous decision model for shipowners in the dry bulk sector.Maritime Policy & Management 33 (2), 141–158.

Feder, J., 1988. Fractals. Plenum, New York.Glen, D., 2006. The modeling of dry bulk and tanker markets: a survey. Maritime Policy

& Management 33 (5), 431–445.Goulielmos, A.M., 2009. Risk analysis of the Aframax freight market and of its

newbuilding and second hand prices, 1976–2008 and 1984–2008. InternationalJournal of Shipping and Transport Logistics. 1 (1), 74–97.

Higgs, H., Worthington, A., 2008. Stochastic price modeling of high volatility, mean-reverting, spike-prone commodities: the Australianwholesale spot electricitymarket.Energy Economics 30 (6), 3172–3185.

Huisman, R., Mahieu, R., 2003. Regime jumps in electricity prices. Energy Economics 25(5), 425–434.

Jing, L., Marlow, P.B., Hui, W., 2008. An analysis of freight rate volatility in dry bulkshipping markets. Maritime Policy & Management 35 (3), 237–251.

Kantelhardt, J.W., Zschiegner, S.A., Bunde, E.K., Havlin, S., Bunde, A., Stanley, H.E., 2002.Multifractal detrended fluctuation analysis of nonstationary time series. Physica A316 (4), 87–114.

Kavussanos, M.G., Alizadeh, A., 2001. Seasonality patterns in the dry bulk shipping spotand time-charter rates. Transportation Research-Part E. Logistics and Transporta-tion Review 37 (6), 443–467.

Kavussanos, M.G., Alizadeh, A., 2002. Efficient pricing of ships in the dry bulk sector ofthe shipping industry. Maritime Policy and Management 29 (3), 303–330.

Kwiatkowski, D.P., Phillips, C.B., Schmidt, P., Shin, Y., 1992. Testing the null hypothesisof stationarity against the alternative of a unit root: how sure are we that economictime series have a unit root? Journal of Econometrics 54 (1–3), 159–178.

MacKinnon, J.G., 1996. Numerical distribution functions for unit root and cointegrationtests. Journal of Applied Econometrics 11 (2), 601–618.

Mandelbrot, B.B., Wallis, J.R., 1969. Robustness of the rescaled range R/S in themeasurement of noncyclic long run statistical dependence. Water Resour. Res. 5(5), 967–988.

Newey, W.K., West, K.D., 1994. Automatic lag selection in covariance matrix estimation.Review of Economic Studies 61 (4), 631–653.

North, C.P., Halliwel, D.I., 1994. Bias in estimating fractal dimension with the rescaled-range (R/S) technique. Math. Geol. 26 (5), 531–555.

Panter, P.F., 1965. Modulation, noise and spectral analysis applied to informationtransmission. McGraw-Hill, New York.

98 S. Engelen et al. / Energy Economics 33 (2011) 88–98

Peng, C.K., Buldyrev, S.V., Havlin, S., Simons, M., Stanley, H.E., Goldberger, A.L., 1994.Mosaic organization of DNA nucleotides. Physical Review E 49 (2), 1685–1690.

Sadegh Movahed, M., Jafari, G.R., Ghasemi, F., Rahvar, S., Rahimi Tabar, M.R., 2006.Multifractal detrended fluctuation analysis of sunspot time series. Journal ofStatistical Mechanics: Theory and Experiment 2006 (2), P02003.

Stopford, M., 2008. Maritime economics. Routledge, London.Strandenes, S.P., 1984. Price determination in the time charter and second hand

markets. Center for Applied Research, Norwegian School of Economics and BusinessAdministration, Working Paper MU 06.

Strandenes, S.P., Adland, R., 2007. A discrete-time stochastic partial equilibrium model ofthe spot freight market. Journal of Transport Economics and Policy 41 (2), 189–218.

Theiler, J., Eubank, S., Longtin, A., Farmer, J.D., 1992. Testing for nonlinearity in timeseries: the method of surrogate data. Physica D 58 (1–4), 77–94.

Tvedt, J., 1997. Valuation of VLCCs under income uncertainty. Maritime Policy andManagement 24 (2), 159–174.

Tvedt, J., 2003. Shipping market models and the specification of freight rate processes.Maritime Economics and Logistics 5 (4), 327–346.

Uritskaya, O., Serletis, A., 2008. Quantifying multiscale inefficiency in electricitymarkets. Energy Economics 30 (6), 3109–3117.

Wang, Y., Liu, L., Gu, R., Cao, J., Wang, H., 2010. Analysis of market efficiency for theShanghai stock market over time. Physica A 389 (8), 1635–1642.