BENCHMARK STATES 10-YEAR · “The markets will listen to that and react,” said Christie, a...

Transcript of BENCHMARK STATES 10-YEAR · “The markets will listen to that and react,” said Christie, a...

Thursday

April 7, 2016

www.bloombergbriefs.com

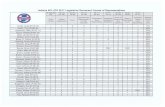

Bloomberg AAA Benchmark Yields

DESCRIPTION CURRENT PREVIOUS NET CHANGE

BVAL Muni Benchmark 1T 0.58 0.58 -0.01

BVAL Muni Benchmark 2T 0.70 0.70 0

BVAL Muni Benchmark 3T 0.84 0.83 +0.01

BVAL Muni Benchmark 4T 0.96 0.98 -0.02

BVAL Muni Benchmark 5T 1.07 1.08 -0.01

BVAL Muni Benchmark 6T 1.19 1.20 -0.01

BVAL Muni Benchmark 7T 1.32 1.33 -0.01

BVAL Muni Benchmark 8T 1.45 1.45 0

BVAL Muni Benchmark 9T 1.56 1.56 +0.01

BVAL Muni Benchmark 10T 1.67 1.66 +0.01

BVAL Muni Benchmark 20T 2.29 2.31 -0.02

BVAL Muni Benchmark 30T 2.59 2.60 -0.01Source: GBY<GO>, GC I493 <GO>

Christie Rejects Making Atlantic City Debt PaymentsBY ELISE YOUNG AND ROMY VARGHESE, BLOOMBERG NEWS

New Jersey Governor said he won’t step in to help Atlantic City avert a Chris Christiedefault on its May bond payment as the distressed gambling hub runs out of money and a takeover bill remains stalled in the state Assembly.

Speaking to reporters in Atlantic City yesterday, Christie said legislation that would let his administration control municipal operations will pass. Not so, Assembly Speaker

said in a statement after the governor’s press briefing.Vincent PrietoThe impasse threatens the finances of Atlantic City, a seaside casino resort of 39,000

that has been upended by the expansion of gambling in nearby states. On Tuesday, the city’s rating was cut to the level of financially distressed Puerto Rico by Moody’s, which said the political standstill heightens the chance of bondholder losses and default.

While Christie said the state won’t make the city’s debt payment, he declined to discuss the repercussions of a default, saying it was “dangerous” to address hypothetical cases.

“The markets will listen to that and react,” said Christie, a second-term Republican.Christie’s comments come as ratings companies increase warnings about how state

action on Atlantic City could affect their views on other local governments in New Jersey. Moody’s said before Christie’s news conference that a city default would hurt the credit quality of distressed cities such as Newark and Paterson.

Atlantic City has $245 million in general-obligation debt, according to Moody’s. Christie's comment last month that bondholders may need to make sacrifices “suggests the state may have reached the point of viewing a default as a desirable outcome,” Moody’s added yesterday.

Asked about that comment, Christie said it wasn’t true, and that passing the legislation is a “desirable” outcome that would forestall a solvency crisis.

Bills supported by Christie and the Senate’s Democratic leader would provide a cash infusion and give the state control over the city’s operations. Christie has said he won’t sign one without the other. To repair Atlantic City’s finances, he says, he needs the power to negotiate affordable union contracts.

STATE YIELD SPREAD TO AAA CHANGE

CA 1.91 25 +0.07

FL 1.81 15 0

IL 3.48 182 +0.09

NY 1.77 11 +0.07

PA 2.38 72 +0.06

TX 1.95 29 +0.06

MUNICIPALITY AMOUNT

Ohio $231 million GO

New York TFA $750 million Rev

Las Vegas NV $138 million GO

Arlington County VA $162 million GO

Harris County MTA TX $125 million RevSource: Bloomberg CDRA <GO>

AMOUNT OUTSTANDING

($MLNS)

MATURING NEXT 30

DAYS ($MLNS)

ANNOUNCED CALLS NEXT 30 DAYS ($MLNS)

3,542,740 9,069 8,030Source: MBM<GO>

BENCHMARK STATES 10-YEAR

PRIMARY FIXED RATE

30-Day Supply Fixed: $11.3 Bln (LT)30-Day Supply Fixed: $176 Mln (ST)Sold YTD Fixed: $74.6 Bln (Neg LT)Sold YTD Fixed: $23.1 Bln (Comp LT)Sold YTD Fixed: $5.3 Bln (ST)

SECONDARY MARKET

MSRB: $11.1 BlnPICK: $15.2 Bln

VARIABLE RATE

SIFMA Muni Swap Rate: 0.39%Bloomberg Weekly AAA Rate: 0.41% Bloomberg Weekly AA Rate: 0.437% Daily Reset Inventory: $191 Mln Weekly Reset Inventory: $1 Bln

IN THE PIPELINE

SIZE OF MARKET

DIARY

April 7, 2016 Bloomberg Brief Municipal Market 2

DIARYPuerto Rico Invites Chaos as Debt Moratorium Upends Progress BY BRIAN CHAPPATTA, MICHELLE KASKE AND STEVEN T. DENNIS, BLOOMBERG NEWS

Puerto Rico risked upending months-long efforts on Wall Street and in Washington to address the commonwealth’s fiscal crisis by authorizing the government to halt payments on a wide swath of its $70 billion debt.

Governor Alejandro Garcia Padillasigned a moratorium bill yesterday, just hours after it won final passage in the legislature. It gives him authority to suspend payments through January 2017 on general-obligation bonds, sales-tax securities and debt from the island’s Government Development Bank and other public agencies.

A default on those obligations would be a first for Puerto Rico, which so far has only failed to pay on bonds backed by legislative appropriation and rum taxes.

“The commonwealth is insolvent and the situation requires responsible efforts to finding a solution,” Garcia Padilla said yesterday in a statement. “This legislation provides us with the tools to address the highest priority of needs — providing essential services to our people — without fear of retribution.”

The decision marks an escalation of Puerto Rico’s fiscal crisis and complicates talks with creditors and U.S. lawmakers that have been dragging on since Garcia Padilla in June declared that the island’s debts were unpayable. The Puerto Rico Electric Power Authority, known as Prepa, already reached an agreement with bondholders that would lower its obligations. Representatives in Congress, after months of debate, drafted legislation last month that would help Puerto Rico restructure its debt.

Facing widespread defaults from the territory, Republicans and Democrats vowed to move swiftly to address the crisis. House Speaker said Paul Ryanthe Natural Resources Committee is working to revise its legislation, which drew opposition from both bondholders facing debt write-offs and island politicians who said it would open the door to a federal

takeover. The committee is set to hold a hearing on April 13.

“The House is committed to a responsible path forward that tackles Puerto Rico’s structural fiscal problems while protecting American taxpayers from footing the bill,” Ryan said in a statement.

The House’s top Democrat, Nancy , said she’s hoping "bipartisan, Pelosi

consensus legislation" can be reached, but that Democrats believe aspects of the draft bill can still be improved.

Garcia Padilla has long held that Puerto Rico can’t continue to pay creditors on time — even those holding constitutionally guaranteed securities — while still providing essential services to its 3.5 million residents.

"Lawmakers have acted precipitously by allowing the governor to unilaterally impose

debt payment moratoriums."

— STEPHEN SPENCER, HOULIHAN LOKEY

He welcomed the proposed federal legislation, but said “the price is too high” in how much control it would give the US over the commonwealth, and previously threatened to call for a moratorium if a deal with investors couldn’t be reached.

Non-constitutionally protected bond payments could be suspended immediately under the island’s law, while those backed by the constitution could be halted starting July 1, when Puerto Rico owes $805 million on its GOs. It also prevents creditors from suing the commonwealth for defaulting through January 2017, the same as the moratorium period.

The act drew criticism from

representatives of bondholders, some of whom have been lobbying Capitol Hill to keep Congress from giving Puerto Rico legal authority to reduce its debt, as cities on the mainland can in Chapter 9.

“Lawmakers have acted precipitously by allowing the governor to unilaterally impose debt payment moratoriums,”

, managing director at Stephen SpencerHoulihan Lokey, an adviser to Prepa bondholders, said in a statement. He said the law may violate the terms of the negotiated agreement, which is “cast into a state of uncertainty.”

GOs with an 8 percent coupon and maturing in 2035 traded yesterday at an average price of 63.9 cents on the dollar, the lowest since the bonds were first sold in March 2014, data compiled by Bloomberg show. The average yield was about 13 percent.

Investors holding GOs had already been working with island lawmakers, excluding the governor, to come to a consensual plan, , a Andy Rosenberglawyer at Paul Weiss Rifkind Wharton and Garrison, said in a statement on Tuesday. He represents a group of bondholders overseeing almost $5 billion of general obligations that released a plan on Tuesday that would put off principal payments for five years, providing debt relief to the island while averting a July default through a new bond deal.

Melba Acosta Febo, president of the GDB for Puerto Rico, said the bondholder proposal isn’t the comprehensive restructuring the island is looking for.

It “fails to solve the severe and real challenges that the commonwealth is now facing,” she said in a statement. “While this proposal would allow the commonwealth to ‘scoop and toss’ its GO obligations and pay GOs interest, it would do so at the expense of holders of all of the other creditors of the commonwealth, many of whom are residents of Puerto Rico.”

The U.S. Treasury Department echoed the GDB president’s push for a broad restructuring, saying the debt moratorium is another reminder of the severity of the island’s crisis.

BREAKING NEWS

April 7, 2016 Bloomberg Brief Municipal Market 3

BREAKING NEWSPuerto Rico Electric Creditors Say Moratorium Jeopardizes Deal BY MICHELLE KASKE, BLOOMBERG NEWS

A debt restructuring agreement between Puerto Rico’s main electricity provider and its creditors is at risk of falling apart after the island’s legislature passed a measure to stop all bond payments, including those of the power utility.

The Puerto Rico Electric Power Authority reached an accord in December with hedge funds, mutual-fund providers and bond-insurance companies to reduce the utility’s $9 billion of debt. The deal involves bondholders taking a 15 percent loss on their securities through a debt exchange. The commonwealth’s House approved the debt moratorium bill early yesterday that allows Governor Alejandro Garcia

to halt payments on all of the Padilla island’s debt.

“Lawmakers have acted precipitously by allowing the governor to unilaterallyimpose debt payment moratoriums, a step that could have unintended consequences and could ultimately prove harmful to the commonwealth’s citizens as well as bondholders,” Stephen

, managing director at Houlihan SpencerLokey, adviser to a group of Prepa bondholders, said in a statement yesterday. “Additionally, imposing a moratorium on payments would likely close the door to anyone extending new credit to Puerto Rico, seriously impeding its ability meet citizens’ needs.”

Jose Echevarria, a Prepa spokesman in San Juan, didn’t immediately respond to an e-mail and phone message.

A debt moratorium “may lead to violations of the terms of the agreement reached between Prepa its creditors,”

Spencer said. “This agreement has set a precedent for negotiated settlements to Puerto Rico’s debt burden, and it should be explicitly preserved, rather than being cast into a state of uncertainty.”

The Prepa agreement is set to expire April 7, unless the utility submits a new rate charge to the island’s Energy Commission. It faces a $1.13 billion payment to investors and lenders on July 1 that it won’t be able to pay without the creditor agreement.

If the Prepa debt-restructuring deal falls apart, it would upend 19 months of negotiations between the parties to craft a plan to ease the agency’s obligations and modernize a system that relies on oil to produce electricity.

Prepa and its creditors entered into a forbearance agreement, which keeps talks out of court, in August 2014 after the utility raided reserve funds to buy fuel.

CREDIT CLOSE-UP

April 7, 2016 Bloomberg Brief Municipal Market 4

CREDIT CLOSE-UPChicago Bondholders Keep the Faith After Pension Fund SetbackBY ELIZABETH CAMPBELL, BLOOMBERG NEWS

Chicago’s biggest bondholders aren’t losing faith.

Nuveen Asset Management, Wells Fargo Asset Management, Columbia Threadneedle Investment Advisers and BlackRock Inc. are showing optimism that the nation’s third-largest city will work its way out of a pension crisis, even after the Illinois Supreme Court rejected Mayor ’s plan to ease Rahm Emanuel$20 billion of unfunded retirement obligations. Despite a lack of help from the gridlocked state of Illinois and mounting liabilities that threaten the city’s solvency, holders of more than $1 billion of the city’s debt, point to Chicago’s growing economy and track record of a willingness to raise taxes. Chicago actually benefits in the short-term from last month’s court ruling. Required pension payments drop by about $89 million this year, relieving some of the immediate pressure on the city budget. The two funds are still projected to run out of money in 10 to 13 years. While the decision was a disappointment, city officials now have a new set of facts to work with as they address the liabilities, said , Chicago’s former chief Lois Scottfinancial officer.

“I almost think it’s good to get this ruling out of the way, and that actually creates a little bit of clarity in terms of what their options are going forward,” said , co-head of fixed John Millerincome in Chicago at Nuveen Asset Management, which oversees about $110 billion in munis, including about $430 million of Chicago general obligations. “It does increase the necessity to work on a reform model that might be a little different, that might actually pass muster.”

The city’s most-actively traded securities over the last week changed hands at an average price of 97 cents on the dollar yesterday, little changed from the day of the ruling, according to data compiled by Bloomberg. Spreads on the bonds that mature in 2038 had widened by 12 basis points over benchmark securities.

Confidence is being buoyed by the fact that Chicago has already shown itscapacity to raise taxes specifically to pay

retirement bills. In October, Emanuel pushed through a record property-tax hike to shore up the public-safety worker pensions. The move won praise from investors who rallied the city’s bonds after the levies were approved.

“They’ve demonstrated a willingness, and they have ability, but they will continue to face budgetary pressure related to this for the foreseeable future,” said , a credit-research Joe Gankiewiczanalyst at BlackRock Inc. in Princeton, New Jersey, which oversees about $110 billion of municipal debt. The firm holds about $157 million of Chicago GO bonds,

"I almost think it’s good to get this ruling out of the way, and

that actually creates a little bit of clarity in terms of what their options are going

forward.” — JOHN MILLER, NUVEEN ASSET

MANAGEMENT.

according to data compiled by Bloomberg, based on market value.

Even with the tax hike dedicated to the public-safety retirement funds, uncertaintystill haunts the police and fire pensions. State lawmakers approved legislation to lower Chicago’s required payment by about $220 million this year, stretching out the amortization of the debt. Republican Governor , Bruce Raunerwho received the bill on March 31, has yet to sign it.

Any kind of assistance from Springfield, the Illinois capital, doesn’t look likely for Chicago. The state has its own fiscal crisis. Illinois is in its 10th month without a budget as Rauner and the Democrat-led legislature can’t agree on a spending

plan.“The noise around Illinois is certainly

making it more difficult for Chicago to get things done,” said , an Dennis Derbyanalyst and portfolio manager at Wells Fargo Asset Management, which holdsabout $466 million, based on market value, of Chicago general obligations among its $39 billion in assets.

Chicago isn’t alone in not having enough money to cover all the benefits that have been promised. Unfunded state and local pension liabilities total $3.5 trillion, Moody’s Investors Service said in a report yesterday. The consequences of not finding a solution are dire: unfunded pension debt helped drive Stockton, California, into Chapter 9, and Detroit into the biggest municipal bankruptcy in U.S. history. Those same unfunded obligations contributed to the crisis in Puerto Rico.

All four credit-rating companies have a negative outlook on Chicago, signaling more rating downgrades may be on the horizon. Fitch Ratings lowered the city to BBB-, one rank above junk, on March 28, calling the court’s decision “‘among the worst possible outcomes.” A week later, Kroll Bond Rating Agency dropped its rating to BBB+, three steps above junk.

“The biggest risk is just that without the flexibility to trim benefits that it’s very likely that the city’s own costs will increase above those that were previously projected,” said , Matt Butlerthe lead analyst on Chicago at Moody’s Investors Service. “One of the key challenge for the city is the pace at which the pension debt continues to grow.”

The city has flexibility on expenditures and revenue, signaling there are options available to incorporate higher contributions over the longer-term, according to Moody’s.

“Their credit quality hinges entirely on their ability to raise revenues or cut costs, and even more importantly, their willingness to do so” to pay for pensions, said , a senior analyst in Ty SchobackMinneapolis at Columbia, which handles about $30 billion in municipal bonds, including about $300 million of Chicago debt. “There is no silver bullet. It’s taken years to get to this point, and it’s going to take years to get out.”

RESULTS OF SALES

April 7, 2016 Bloomberg Brief Municipal Market 5

Long-Term Bond Sales Results

SELLING DATE

ISSUE STATE RATING TAXAMT

($Mlns)1 YEAR 5 YEAR 10 YEAR 20 YEAR STATUS TYPE

SENIOR MANAGER

ENHANCEMENT

04/04Tarrant Co Cultural Edu

TX Aa3e// N 377.094.000/0.740

3.000/1.330

5.000/2.130

4.000/3.160

Repriced NegtCitigroup Global Mkts Inc

04/04University Of Connecticut

CTAa3/AA

/AA-N 261.84

4.000/0.700

5.000/1.400

5.000/2.150

4.000/3.110

Final Negt Jefferies Llc

04/04Fairfax Co -Swr -Ref -A

VAAaa/AAA

/AAAN 164.45

4.000/1.130

5.000/1.710

3.500/2.970

Fianl NegtJP Morgan Securities Llc

04/04 Burleson Isd-Ref TX Aaa //AAA N 120.722.000/0.740

3.000/1.360

5.000/1.940

4.000/2.830

Final NegtRaymond James & Assocs

PSF-GTD

04/04Guilford Cnty-Ref - A

NCAaae/AAA

/AAAeN 93.04

2.000/0.570

5.000/1.000

5.000/1.670

Repriced NegtWells Fargo Bank N.A.

04/04Las Vegas Redev Agy -Ref

NV /BBB+/ N 83.404.000/1.700

5.000/2.460

3.375/3.510

Final NegtStifel Nicolaus & Co Inc

04/04University Of Connecticut

CTAa3/AA

/AA-N 80.51

4.000/0.700

5.000/1.400

5.000/2.150

Repriced Negt Jefferies Llc

04/04Wppi Energy - A - Ref

WI A1/A/A+ N 76.085.000/1.230

5.000/2.010

5.000/2.780

Repriced NegtJP Morgan Securities Llc

04/04Purdue Univ Trustees -A

IN Aaae/AAA/ N 66.883.000/0.610

5.000/1.100

4.000/1.770

5.000/2.460

Repriced NegtMorgan Stanley & Co Llc

04/04Allegheny Co Hgr Edu Bldg

PA A2e/A/ N 58.954.000/1.420

5.000/2.210

Repriced NegtBank Of America Merrill Lynch

*Moody's/S&P/Fitch

Most Active Bonds

DESCRIPTION STATE DATED COUPON MATURITY VOLUME PRICED AVERAGE YIELD AVERAGE NO. OF TRADES

Lwr Neches Vy Dev-Var TX 11/09/10 N.A. 11/01/38 61,200,000 100.000 0.000 14

Puerto Rico-A PR 03/17/14 8.000 07/01/35 52,455,000 66.053 12.774 43

New York City Ny Tran NY 03/17/16 4.000 07/15/40 42,240,000 108.305 3.012 88

Golden St Tobacco Sec CA 04/07/15 5.000 06/01/45 39,750,000 116.207 2.964 23

Ky Prop & Bldg-B KY 03/23/16 5.000 11/01/25 30,000,000 121.621 2.450 6

Wisconsin St WI 03/16/16 5.000 05/01/35 29,000,000 121.417 2.361 13

Ca St Univ-A CA 04/20/16 5.000 11/01/41 25,200,000 120.351 2.673 6

Ca Var-B5-Kindergarte CA 10/21/04 N.A. 05/01/34 25,000,000 100.000 0.000 5

Il St Unemployment-A IL 07/31/12 5.000 06/15/16 25,000,000 100.865 0.489 5

Nyc Muni Wtr Fin-Bb NY 11/21/13 5.000 06/15/46 25,000,000 116.992 2.410 5

New York St Urban Dev NY 03/17/16 5.000 03/15/25 25,000,000 126.719 1.756 5

Ohio St Univ-Txbl-A OH 03/09/16 3.798 12/01/46 24,540,000 104.959 3.532 6

Ca St Univ-A CA 04/20/16 4.000 11/01/35 24,125,000 110.666 2.774 6

Revere -Bans MA 04/15/16 2.000 04/14/17 23,350,000 101.255 0.730 9

Ca St Univ-A CA 04/20/16 4.000 11/01/37 21,775,000 109.473 2.904 16

New York City Ny Tran NY 03/17/16 5.000 07/15/32 21,345,000 122.416 2.410 10

Nj Econ Dev--Qq-Txbl NJ 05/06/14 1.096 06/15/16 21,100,000 99.956 1.327 5

Lower Neches-Exxon TX 11/17/11 N.A. 11/01/51 20,600,000 100.000 0.000 6

Ca St Univ-A CA 04/20/16 3.000 11/01/33 20,470,000 99.857 3.006 32

RESULTS OF SALES

TRADING

April 7, 2016 Bloomberg Brief Municipal Market 6

STORYCHART

April 7, 2016 Bloomberg Brief Municipal Market 7

STORYCHART

Prison Population Is Falling in Biggest Jailer Among Developed NationsBY DEIRDRE FRETZ, BLOOMBERG BRIEF

The number of sentenced prisoners in the U.S. fell in 2014, according to the most recent data from the U.S. Bureau of Justice Statistics.

Nationwide, incarceration rates of sentenced prisoners peaked in 2007. The population of state and federal prisons within California fell from 342 per 100,000 state residents in 2007 to 257 in 2014.

Click the chart to launch an interactive StoryChart to see what states have the highest incarceration rates, and how the U.S. compares to other developed nations.

ACCORDING TO

Louisiana Has Highest Incarceration Rate in United States

Source: Bureau of Justice Statistics

April 7, 2016 Bloomberg Brief Municipal Market 8

SETTLE BORROWER STCOUPON

MODEAMOUNT ($MLNS)

LIQUIDITY PROVIDER REMARKETING AGENT TAXINDEX

FLOATER

03/01/17 New York State Housing Finance Agency NY M 35Deutsche Bank Secs Inc

N 1M LIBOR

04/06/16 EQR-Fairfield LLC CT W 32 Fannie MaeJP Morgan Securities Llc

N VRDO

04/06/16Metropolitan Water District of Southern California

CA W 125 RBC Capital Markets T 1M LIBOR

04/05/16 555 Tenth Housing LLC NY W 140Landesbank Hessen-Thrgn

Barclays Capital Inc T VRDO

04/01/16 Community Howard Regional Health Inc IN W 20 Bmo Harris Bank NA Wells Fargo Bank N.A. N VRDO

04/01/16 Hampton Roads Sanitation District VA W 50JP Morgan Securities Llc

N VRDO

04/01/16 J Paul Getty Trust/The CA W 81 Wells Fargo Bank N.A. N 1M LIBOR

03/30/16 City of Peoria IL IL W 10 Bmo Harris Bank NA Mesirow Financial Inc N VRDO

03/30/16 Iowa Finance Authority IA W 20Federal Home Loan Bank

RBC Capital Markets N VRDO

03/29/16 Dallas Independent School District TX A 30Citigroup Global Mkts Inc

N VRDO

03/24/16 Housing Development Corp/NY NY S 43 Barclays Capital Inc N VRDO

03/24/16 Housing Development Corp/NY NY Q 75JP Morgan Securities Llc

N VRDO

03/24/16 Housing Development Corp/NY NY Q 138JP Morgan Securities Llc

N VRDO

Source: CDRV<GO>

ACCORDING TO

A Puerto Rico House member is seeking to amend the commonwealth’s debt-moratorium law to remove general-obligations, sales-tax debt and other securities from its power. Governor

yesterday Alejandro Garcia Padillasigned into law a measure that enables him to suspend payments on all of the island’s debt through January 2017. House members may vote as soon as April 14 to change that law to remove general obligations, sales-tax bonds and debt sold by the island’s water utility and electricity provider, Rafael ’Tatito’

, sponsor of the bill and chair Hernandezof the House Treasury Committee, said in a telephone interview. Safeguarding those securities from the debt-moratorium law will preserve those credits from defaulting, Hernandez said. “The only tools that we have are the GOs and the securitizations,” Hernandez said. Removing those entities from the law reduces Puerto Rico’s ability

Moratorium Change Offered to preserve cash by skipping debt payments. The commonwealth and itsagencies owe $70 billion, with $2 billion of principal and interest due July 1 that Garcia Padilla says the island cannot pay.

— Michelle Kaske, Bloomberg News

Oklahoma had the outlook on its bond rating cut to negative by Standard & Poor's, which cited budget pressures fueled by a decline in oil prices that reduced state revenue. A projected deficit for fiscal 2017 that’s equal to nearly a fifth of the budget and diminished reserves could reduce the state's financial flexibility if tax revenue doesn’t revive, S&P said yesterday. Recent cuts to the personal income-tax rate and breaks for oil industry “compounded” the revenue shortfall, according to the company, which rates the state AA+, the second-highest grade. Oklahoma is emerging as one of the

Oklahoma Bond Rating Risk

states hardest hit by oil’s slide to about $38 a barrel, less than half what it was two years ago. The economic and financial fallout has already led S&P to strip Alaska and North Dakota of their AAA ratings. “The state faces significant challenges to achieve structural balance,” S&P said in a statement. “Oklahoma has relied on nonrecurring measures to balance its fiscal 2016 budget, and should structural imbalance persist, coupled with lower reserve balances, we could lower the rating.” Since Governor Mary Fallin proposed her 2017 budget, the projected deficit has risen from $900 million to $1.3 billion, S&P said, while revenue-raising steps that would close the gap face “political hurdles.” The state has cut spending by 7 percent to address 2016 gaps and used $80 million of reserves.

S&P issued the report with a rating of AA on the state’s planned sale of Oklahoma Development Finance Authority debt for higher education.

— Darrell Preston, Bloomberg News

RECENT VARIABLE RATE ISSUANCE

TWEET OF THE DAY BY JOE MYSAK, BLOOMBERG BRIEF

April 7, 2016 Bloomberg Brief Municipal Market 9

Find Muni Data on the Bloomberg Terminal

DATA FREQUENCY ON THE TERMINAL

AAA Benchmark Valuation Daily GC I493 <GO>

Benchmark State Yields Daily MBM <GO>

VRDO Rates, Inventory Daily MBIX <GO>, ALLX BVRD <GO>

Upcoming Sales Daily CDRA <GO>

Volume, MSRB, PICK Daily SPLY <GO>, YTDM <GO>, MSRB <GO>, MBIX <GO>

Results of Sales Daily CDRA <GO>

Most Active Daily MSRB <GO>

Most Searched DES Every Wednesday SECF <GO>

Variable-Rate Calendar Every Thursday CDRV <GO>

Most Traded Borrowers Every Friday MFLO <GO>

Week-Ahead Calendar Every Monday CDRA <GO>

Supply and Demand Every Friday SPLY <GO>, BVMB <GO>

Muni Credit Risk Every Monday MRSK <GO>

TWEET OF THE DAY BY JOE MYSAK, BLOOMBERG BRIEF

GO Holders Pitch Puerto Rico Scoop and Toss

Susannah Page@susannahlpage

@munidog Well yeah they're not suggesting PR stops issuing more debt. See the GO bondholders scoop & toss proposalDetails

The municipal analyst weighs in on certain Puerto Rico general-obligation bondholders' proposal to defer principal payments for five years while selling a new 7 percent $750 million GO issue to stave off a July 1 default.

Bloomberg Brief:Municipal Market

Newsletter Managing Editor

Jennifer Rossa

Municipal Market Editor

Joe Mysak

Brief Editor

Siobhan Wagner

Contributing Analyst

Sowjana Sivaloganathan

Municipal Data Team

Marketing & Partnership Director

Johnna Ayres

+1-212-617-1833

Advertising

Christopher Konowitz

+1-212-617-4694

Reprints & Permissions

Lori Husted

+1-717-505-9701 x2204

Interested in learning more about the Bloomberg

terminal? Request a free demo .here

This newsletter and its contents may not be

forwarded or redistributed without the prior

consent of Bloomberg. Please contact our

reprints and permissions group listed above for

more information. Bloomberg believes the

information herein came from reliable sources,

but does not guarantee its accuracy.

© 2016 Bloomberg LP. All rights reserved.

![INHALT WARNINGS UND WEITERES GURTMONTAGE · PDF file“Flexi Belt™” 30 - 32 Doppelsteg [Beckengurt] 33 Beschläge und Endschlaufen 34 - 48 OPERATION 48 - 56 Sichere ... Profi und](https://static.fdokument.com/doc/165x107/5a78f2d97f8b9a83238ed1c0/inhalt-warnings-und-weiteres-gurtmontage-flexi-belt-30-32-doppelsteg-beckengurt.jpg)