Str Final Project1(02)

-

Upload

charu-bansal -

Category

Documents

-

view

219 -

download

0

Transcript of Str Final Project1(02)

-

8/13/2019 Str Final Project1(02)

1/72

Page 1

CHAPTER-1

INTRODUCTION

-

8/13/2019 Str Final Project1(02)

2/72

Page 2

INTRODUCTION

Stock markets refer to a market place where investors can buy and sell stocks. The price at which each

buying and selling transaction takes is determined by the market forces (i.e. demand and supply for a particular stock).

A stock market is a public market for the trading of company stock and derivatives at an agreed price;

these are securities listed on a stock exchange as well as those only traded privately.

The size of the world stock market was estimated at about $36.6 trillion USD at the beginning of

October 2008.

The stock market is one of the most important sources for companies to raise money. This allows

businesses to be publicly traded, or raise additional capital for expansion by selling shares of

ownership of the company in a public market.

In fact, the stock market is often considered the primary indicator of a country's economic strength and

development. Rising share prices, for instance, tend to be associated with increased business

investment and vice versa.

In this way, investing in stock market, the stock exchanges also play importance role. Exchanges also

act as the clearinghouse for each transaction, meaning that they collect and deliver the shares, and

guarantee payment to the seller of a security. This eliminates the risk to an individual buyer or seller

that the counterparty could default on the transaction. So, here we also understand about StockExchanges as follows.

-

8/13/2019 Str Final Project1(02)

3/72

Page 3

HISTORY OF STOCK MARKET

The emergence of stock market can be traced back to 1830. In Bombay, business passed in the shares

of banks like the commercial bank, the chartered mercantile bank, the chartered bank, the oriental bank and the old bank of Bombay and shares of cotton presses. In Calcutta, Englishman reported the

quotations of 4%, 5%, and 6% loans of East India Company as well as the shares of the bank of

Bengal in 1836. This list was a further broadened in 1839 when the Calcutta newspaper printed the

quotations of banks like union bank and Agra bank. It also quoted the prices of business ventures like

the Bengal bonded warehouse, the Docking Company and the storm tug company. Between 1840 and

1850, only half a dozen brokers existed for the limited business. But during the share mania of 1860-

65, the number of brokers increased considerably. By 1860, the number of brokers was about 60 and

during the exciting period of the American Civil war, their number increased to about 200 to 250. The

end of American Civil war brought disillusionment and many failures and the brokers decreased in

number and prosperity. It was in those troublesome times between 1868 and 1875 that brokers

organized an informal association and finally as recited in the Indenture constituting the Articles of

Association of the Exchange.

On or about 9th day of July,1875, a few native brokers doing brokerage business in shares and stocks

resolved upon forming in Bombay an association for protecting the character, status and interest of

native share and stock brokers and providing a hall or building for the use of the Members of suchassociation.

As a meeting held in the broker Hall on the 5th day of February, 1887, it was resolved to execute a

formal deal of association and to constitute the first managing committee and to appoint the first

trustees. Accordingly, the Articles of Association of the Exchange and the Stock Exchange was

formally established in Bombay on 3rd day of December, 1887. The Association is now known as

The Stock Exchange

The entrance fee for new member was Re.1 and there were 318 members on the list, when the

exchange was constituted.

The numbers of members increased to 333 in 1896, 362 in 1916, and 478 in 1920 the entrance fee was

raised to Rs.5 in 1877, Rs.1000 in 1896, Rs. 2500 in 1916, Rs. 48,000 in 1920.At present there are 23

recognized stock exchanges with about 6000 stock brokers.

-

8/13/2019 Str Final Project1(02)

4/72

Page 4

STOCK EXCHANGE

A stock exchange is an entity which provides "trading" facilities for stock brokers and traders, to tradestocks and other securities. Stock Exchanges are an organized marketplace, either corporation or

mutual organization, where members of the organization gather to trade company stocks or other

securities. Stock exchanges also provide facilities for the issue and redemption of securities as well as

other financial instruments and capital events including the payment of income and dividends.

The securities traded on a stock exchange include: shares issued by companies, unit trusts, derivatives,

pooled investment products and bonds. To be able to trade a security on a certain stock exchange, it

has to be listed there. Usually there is a central location at least for recordkeeping, but trade is less and

less linked to such a physical place, as modern markets are electronic networks, which gives them

advantages of speed and cost of transactions. Trade on an exchange is by members only. The initial

offering of stocks and bonds to investors is by definition done in the primary market and subsequent

trading is done in the secondary market.

A stock exchange is often the most important component of a stock market. Supply and demand in

stock markets is driven by various factors which, as in all free markets, affect the price of stocks.

There is usually no compulsion to issue stock via the stock exchange itself, nor must stock be

subsequently traded on the exchange. Such trading is said to be off exchange or over-the-counter. Thisis the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a

global market for securities.

The two major Stock Exchanges from India are

Bombay Stock Exchange

National Stock Exchange

http://en.wikipedia.org/wiki/Investorhttp://en.wikipedia.org/wiki/Bond_%28finance%29http://en.wikipedia.org/wiki/Bond_%28finance%29http://en.wikipedia.org/wiki/Investor -

8/13/2019 Str Final Project1(02)

5/72

-

8/13/2019 Str Final Project1(02)

6/72

Page 6

RESEARCH METHODOLOGY

Market research is often needed to ensure that we produce what customers really want and not what

we think they want. Research methodology is a way to systematically solve the research problem. I

may be understood as a science of how research is done scientifically understand it be study the

various steps that are generally adopted by a researcher in study his research problem along with the

logic behind them. It is necessary for the researcher to know not only the research methods or

technique but also research methodology. It refers to a search for knowledge.

Research is thus an original contribution to the existing stock of knowledge making for its

advancement. It is the pursue of truth with the help of study.

DATA COLLECTION

Data is information in the form of numerical figures. Data obtained in the original form is called raw

data.

METHODS OF DATA COLLECTION

Primary DataIt involves collecting data from its origin. Primary data is the first hand information collected by the

marketer. This method of data collection is expensive and time consuming.

Secondary Data

It involves using information that have already put together. When we collect information through

published sources, it is known as secondary data collection.

In my project primary as well as secondary data is being used. Mainly the data used in my project is

secondary data.

-

8/13/2019 Str Final Project1(02)

7/72

Page 7

.RESEARCH DESIGN

It is used in rigid who involve specific guidelines to reach the financial result data is collecting on

specific parameter.

TYPES OF RESEARCH

There are three types of research

Descriptive

Explanatory

Exploratory

Descriptive research

A form of conclusion research that aims to describe a product or market or identify associations

among variables. As the name suggests, descriptive research is concerned with describing market

characteristics and/or marketing mix characteristics. This type of study can involve the description of

the extent of association between variables.

Explanatory researchIt is research in which each and everything is well explained. A style of research in which the primary

goal is to understand the nature or mechanism of the relationship between the independent and

dependent variable.

Exploratory research

This research is conducted into an issue or problem where there are few or no earlier studies to refer.

The focus is on gaining insights and familiarity for later investigation. Here data is often quantitative

and statistics applied. It is used to identify and obtain information on a particular problem or issue.

Finally, casual or predictive research seeks to explain what is happening in a particular situation.

-

8/13/2019 Str Final Project1(02)

8/72

Page 8

In my project I have used exploratory research for primary data because it is undertaken to explore

an area where little is known or to investigate the possibilities of undertaking a particular research

study

In my project I have also used descriptive research for secondary data because the main goal of this

type of research is to describe the data and characteristics about what is being studied and descriptive

research is mainly done when a researcher wants to gain a better understanding of a topic It is

quantitative and uses surveys and panels and also the use of probability sampling.

-

8/13/2019 Str Final Project1(02)

9/72

Page 9

CHAPTER-2

STRUCTURE OF

STOCK MARKET

-

8/13/2019 Str Final Project1(02)

10/72

Page10

ORGANISATION STRUCTURE OF STOCK EXCANGE

Organization structure of stock exchange varies14 stock exchanges are organized as public limitedcompanies, 6 as companies limited by guarantee and 3 are non-profit voluntary organization. Of the

total of 23, only 9 stock exchanges have been permanent recognition. Others have to seek recognition

on annual basis.

These exchange do not work of its own, rather, these are run by some persons and with the help of

some persons and institution. All these are down as functionaries on stock exchange. These are:

Stockbrokers

Sub- Portfolio consultants

Broker

Market makers

Stockbrokers:

Stock brokers are the members of stock exchanges. These are the persons who buy, sell or deal in

securities. A certificate of registration from SEBI is mandatory to act as a broker. SEBI can impose

certain conditions while granting the certificate of registrations. It is obligatory for the person to abide

by the rules, regulations and the buy-law. Stock brokers are commission broker, floor broker,arbitrageur etc.

Sub-broker:

A sub-broker acts as agent of stock broker. He is not a member of a stock exchange. He assists the

investors in buying, selling or dealing in securities through stockbroker. The broker and sub-broker

should enter into an agreement in which obligations of both should be specified. Sub-broker must be

registered SEBI for a dealing in securities. For getting registered with SEBI, he must fulfill certain

rules and regulation

Market Makers:

Market maker is a designated specialist in the specified securities. They make both bid and offer at the

same time. A market maker has to abide by bye-laws, rules regulations of the concerned stock

-

8/13/2019 Str Final Project1(02)

11/72

Page11

exchange. He is exempt from the margin requirements. As per the listing requirements, a company

where the paid-up capital is Rs. 3 Crore but not more than Rs. 5 core and having a commercial

operation for less than 2 years should appoint a market maker at the time of issue of securities.

Portfolio Consultants:

A combination of securities such as stocks, bonds and money market instruments is collectively called

as portfolio. Whereas the portfolio consultants are the persons, firms or companies who advise, direct

or undertake the management or administration of securities or funds on behalf of their clients.

Traditionally stock trading is done through stock brokers, personally or through telephones.

As number of people trading in stock market increase enormously in last few years, some issues like

location constrains, busy phone lines, miss communication etc start growing in stock broker offices.

Information technology (Stock Market Software) helps stock brokers in solving these problems withOnline Stock Trading.

Online Stock Market Trading is an internet based stock trading facility. Investor can trade shares

through a website without any manual intervention from Stock Broker

MEANS OF FINANCING

Financing a company through the sale of stock in a company is known as equity financing.

Alternatively debt financing (for example issuing bonds) can be done to avoid giving up shares of

ownership of the company.

Trading:

Shares of stock are usually traded on a stock exchange, where people and organizations may buy and

sell shares in a wide range of companies. A given company will usually only trade its shares in one

market, and it is said to be quoted, or listed, on that stock exchange. However, some large,

multinational corporations are listed on more than one exchange. They are referred to as inter-listed

shares.

-

8/13/2019 Str Final Project1(02)

12/72

Page12

Buying:

There are various methods of buying and financing stocks. The most common means is through a

stock broker. Whether they are a full service or discount broker, they are all doing one thing

arranging the transfer of stock from a seller to a buyer. Most of the trades are actually done through

brokers listed with a stock exchange such as the Bombay Stock Exchange. There are many different

stock brokers to choose from such as full service brokers or discount brokers. The full service brokers

usually charge more per trade, but give investment advice or more personal service; the discount

brokers offer little or no investment advice but charge less for trades. Another type of broker would be

a bank or credit union that may have a deal set up with either a full service or discount broker.

There are other ways of buying stock besides through a broker. One way is directly from the company

itself. If at least one share is owned, most companies will allow the purchase of shares directly from

the company through their investor's relations departments. However, the initial share of stock in thecompany will have to be obtained through a regular stock broker.

Another way to buy stock in companies is through Direct Public Offerings which are usually sold by

the company itself. A direct public offering is an initial public offering a company in which the stock

is purchased directly from the company, usually without the aid of brokers. When it comes to

financing a purchase of stocks there are two ways: purchasing stock with money that is currently in the

buyers ownership or by buying stock on margin. Buying stock on margin means buying stock with

money borrowed against the stocks in the same account.

These stocks, or collateral, guarantee that the buyer can repay the loan; otherwise, the stockbroker has

the right to sell the stocks (collateral) to repay the borrowed money. He can sell if the share price

drops below the margin requirement, at least 50 percent of the value of the stocks in the account.

Buying on margin works the same way as borrowing money to buy a car or a house using the car or

house as collateral.

Selling:

Selling stock in a company goes through many of the same procedures as buying stock. Generally, the

investor wants to buy low and sell high, if not in that order; however, this is not how it always ends up.

Sometimes, the investor will cut their losses and claim a loss. As with buying a stock, there is a

transaction fee for the broker's efforts in arranging the transfer of stock from a seller to a buyer. This

fee can be high or low depending on if it is a full service or discount broker.

-

8/13/2019 Str Final Project1(02)

13/72

Page13

After the transaction has been made, the seller is then entitled to all of the money. An important part of

selling is keeping track of the earnings. It is important to remember that upon selling the stock, in

jurisdictions that have them, capital gains taxes will have to be paid on the additional proceeds, if any,

that are in excess of the cost basis.

Short selling:

This is a reverse cycle of buying & selling process. Traders can directly sell the shares before they buy

them at a higher price and after that buying the same quantity of shares at lower price. This normally

happens during anticipation of fall of price in a stock. The trader must clear his position before that

trading day. This strategy is usually followed by day traders.

Technology and Trading:Stock trading has evolved tremendously. Since the very first Initial Public Offering (IPO) in the 13th

century, owning shares of a company has been a very attractive incentive. Even though the origins of

stock trading go back to the 13th century, the market as we know it today did not catch on strongly

until the late 1800s.

Co-production between technology and society has led the push for effective and efficient ways of

trading. Technology has allowed the stock market to grow tremendously, and all the while society has

encouraged the growth. Within seconds of an order for a stock, the transaction can now take place.

Most of the recent advancements with the trading have been due to the Internet. The Internet has

allowed online trading. In contrast to the past where only those who could afford the expensive stock

brokers, anyone who wishes to be active in the stock market can now do so at a very low cost per

transaction.

Trading can even be done through Computer-Mediated Communication (CMC) use of mobile devices

such as hand computers and cellular phones. These advances in technology have made day trading

possible. The stock market has grown so that some argue that it represents a country's economy. This

growth has been enjoyed largely to the credibility and reputation that the stock market has earned

-

8/13/2019 Str Final Project1(02)

14/72

Page14

TYPES OF SHARES

Equity shares:These shares are also known as ordinary shares. They are the shares which do not enjoy any

preference regarding payment of dividend and repayment of capital. They are given dividend at a

fluctuating rate. The dividend on equity shares depends on the profits made by a company. Higher the

profits, higher will be the dividend, where as lower the profits, lower will be the dividend.

Preference shares:

These shares are those shares which are given preference as regards to payment of dividend and

repayment of capital. They do not enjoy normal voting rights. Preference shareholders have some

preference over the equity shareholders, as in the case of winding up of the company, they are paid

their capital first. They can vote only on the matters affecting their own interest.

These shares are best suited to investors who want to have security of fixed rate of dividend and

refund of capital In case of winding up of the company.

Deferred shares:

These shares are those which are held by the founders or pioneer or beginners of the company. Theyare also called as founder shares. In deferred shares, the right to share the profits of the company is

deferred, i.e. postponed till all the other shareholders receive their normal dividends. Being the last

claimants of the profits, they have the considerable element of speculation or uncertainty or they have

to bear the greatest risk of loss.

The market price of such shares shows a very wide fluctuation on account of wide dividend

fluctuations. Deferred shares have disproportionate voting rights. These shares have a small

denomination or face value. Deferred shares are not transferable if issued by a private company.

Deferred shareholders do not enjoy the right of priority to have shares offered in case of the issue of

the shares by the company. If the company goes in to the liquidation the deferred shareholders can get

refund of capital and participate in the surplus capital, if any, after the rights of preference and equity

shareholders have been satisfied.

-

8/13/2019 Str Final Project1(02)

15/72

-

8/13/2019 Str Final Project1(02)

16/72

Page16

TYPES OF MARKETS

Primary market (IPOs):

In financial markets, an Initial Public Offering (IPO) is the first sale of a company's common shares to

public investors. The company will usually issue only primary shares, but may also sell secondary

shares. Typically, a company will hire an investment banker to underwrite the offering and a corporate

lawyer to assist in the drafting of the prospectus. The sale of stock is regulated by authorities of

financial supervision and where relevant by a stock exchange.

It is usually a requirement that disclosure of the financial situation and prospects of a company be

made to prospective investors. The Federal Securities and Exchange Commission (SEC) regulates the

securities markets of the United States and, by extension, the legal procedures governing IPOs. The

law governing IPOs in the United States includes primarily the Securities Act of 1933, the regulations

issued by the SEC, and the various state "Blue Sky Laws".

Secondary market:

The secondary market (also called "aftermarket") is the financial market for trading of securities thathave already been issued in its initial private or public offering. Stock exchanges are examples of

secondary markets. Alternatively, secondary market can refer to the market for any kind of used

goods.

Function of the secondary market:

In the secondary market, securities are sold by and transferred from one speculator to another. It is

therefore important that the secondary market be highly liquid and transparent. The eligibility of

stocks and bonds for trading in the secondary market is regulated through financial supervisory

authorities and the rules of the market place in question, which could be a stock exchange

-

8/13/2019 Str Final Project1(02)

17/72

Page17

TRADING

Trading is the process of buying and selling securities.

TYPES OF TRADING

Day Trading :

Day traders buy and sell stocks throughout the day in the hope that the price of the stocks willfluctuate in value during the day, allowing them to earn quick profits. A day trader will hold a stock

anywhere from a few seconds to a few hours, but will always square off all of those stocks before the

close of each day. The day trader does not own any positions at the close of any day therefore immune

to overnight risks. The objective of day trading is to quickly get in and out of any particular stock for a

profit on an intra-day basis.

Day trading can be further subdivided into a number of styles, including :

Scalpers

This style of day trading involves the rapid and repeated buying and selling of a large volume of

stocks within seconds or minutes. The objective is to earn a small per share profit on each transaction

while minimizing the risk.

Momentum Traders

This style of day trading involves identifying and trading stocks that are in a moving pattern during the

day, in an attempt to buy such stocks at bottoms and sell at tops.

Online Trading

Online trading is simply a term that refers to the medium used to enter and execute trades. Online

traders, which can include long term investors, as well as day, swing and position traders, use either an

-

8/13/2019 Str Final Project1(02)

18/72

Page18

Internet connection or a direct access online trading platform to access and execute trades with Web

based brokers.

Hedging:

Hedging means reducing risk exposure in the market. A hedge is an investment that is taken out

specifically to reduce or cancel out the risk in another investment. Hedging is a strategy design to

minimize exposure to an unwanted business risk, while still allowing the business to profit from an

investment activity. In effect it is similar to purchasing an insurance policy on your financial security.

Buying or selling options, along with the buying and selling of the underlying security is a common

way to hedge.

Spreading: A spread is defined as the sale of one or more futures contracts and the purchase of one or more

offsetting futures contracts. A spread tracks the difference between the prices of whatever it is you are

long and whatever it is you are short. Therefore the risk changes from that of price fluctuation to that

of the difference between the two sides of the spread.

The spreader is a trader who positions himself between the speculator and the hedger. Rather than take

the risk of excessive price fluctuation, he assumes the risk in the difference between two different

trading months of the same futures, the difference between two related futures contracts in different

markets, between equity and an index, or between two equities.

Delivery based:

Delivery based trading is normally considered as a safer approach for trading in shares when compared

to day trading. Delivery based trading involves buying shares on a market day and selling them only

after receiving the delivery of those shares in demat account.

It is basically in 3 forms.

Short term: The trading can be done only for one to three months.

Medium term: Here, the trading can be done for 6 months.

-

8/13/2019 Str Final Project1(02)

19/72

Page19

ADVANTAGES OF STOCKS TRADI NG:

1. Better returns

Actively trading stocks can produce better overall returns than simply buying and holding.

2. Huge Choice

There are thousands of stocks listed on markets around the world. There is always a stock whose price

is moving - i ts just a matter of finding them.

3. Familiarity

The most traded stocks are in the largest companies that most of us have heard of and understand -

Microsoft, IBM, and Cisco etc.

-

8/13/2019 Str Final Project1(02)

20/72

Page20

DISADVANTAGES OF STOCKS TRADING:

1. Leverage

With a margined account the maximum amount of leverage available for stock trading is usually 4:1.Meaning a $25,000 could trade up to $100,000 of stock. This is pretty low compared to for ex trading

or futures trading.

2. Pattern Day Trader Rules

It requires at least $25,000 to be held in a trading account if the trader completes more than 4 trades in

a 5 day period. No such rule applies to For ex trading or futures trading.

3. Uptick Rule on Short Selling

A trader must wait until a stock price ticks up before they can short sell it. Again there are no such

rules in For ex trading or futures trading where going short are as easy as going long.

4. Need to Borrow Stock to Short

Stocks are physical commodities and if a trader wishes to go short then the broker must have

arrangements in place to borrow that stock from a shareholder until the trader closes their position.

This limits the opportunities available for short selling. Contrast this to futures trading where selling is

as easy as buying.

-

8/13/2019 Str Final Project1(02)

21/72

Page21

CHAPTER-3

COMPANY PROFILE

-

8/13/2019 Str Final Project1(02)

22/72

Page22

COMPANY PROFILE

Company Name: SHAREKHAN LIMITED

Parental Company: SSKI Group

(Shripal Sevantilal Kantilal Ishwarlal Pvt. Ltd)

Establishment year: 1922

CEO of the company: Mr. Tarun ShahHead Office: A-206, Phoenix House,

2nd Floor, Senapati Bapat Marg,

Lower Parel,

Mumbai- 400 013.

Jhandewala Main Branch:

(Where I have taken training) E-4,3 rd Floor, Inner Circle, Above

Pizza Hutt, Connaught Place, new delhi-110001

Telephone No: (022) 67482000

0261- 6560310-314

Online division as Sharekhan

8th February 2000

Web Site: www.sharekhan.com

Offices(Network): More than 640 outlets in 280 cities

-

8/13/2019 Str Final Project1(02)

23/72

Page23

INTRODUCTION OF SHAREKHAN

Sharekhan is one of the leading share broking and retail brokerage firms in the country. It is the

retail broking arm of the Mumbai-based SSKI Group (Shripal Sevantilal Kantilal Ishwarlal Pvt.

Ltd), which has more than 88 years of experience in the stock broking business. SSKI is a

veteran equities solutions company with more than 8 decades of trust and credibility in the

Indian stock markets. It helps the customers/people to make informed decisions and simplifies

investing in stocks.

Sharekhan brings to you a user- friendly online trading facility, coupled with a wealth of content

that will help you stalk the right shares. SSKI named its online division as a Sharekhan and it is

into retail broking. The business of the company overhauled 12 years ago on February 8, 2000. It

acts as a discount brokerage house to a full service investment solution provider. It has

specialized research product for the small investors and day traders. Sharekhans online trading

and investment site www.sharekhan.com was launched in 2000.

Though the www.sharekhan.com, have been providing investors a powerful online trading

platform, the latest news, research and other knowledge-based tools and Sharekhan's equity

related services include trade execution on BSE, NSE, Derivatives, commodities, depositoryservices, online trading and investment advice.

They have talent pool of experienced professionals specially designated to guide you when you

need assistance, which is hyinvestigating with us is bound to be a hassle-free experience for you!

The Sharekhan provides its Customers First Step program, built specifically for all investors, so

testament is

YOUR GUIDE TO THE FINANCIAL JUNGLE means

Our commitment to being your guide throughout your investing lifecycle

The institutional broking arm of SSKI was also awarded Indias best broking house for 2004 by

Asia Money brokers poll recently & It has also won the prestigious Awaaz Consumer Vote

Awards 2005 for the Most Preferred Stock Broking Brand in India, in the Investment Advisors

category.

-

8/13/2019 Str Final Project1(02)

24/72

Page24

Sharekhan won the award by the vote of consumers around the country, as part of Indias largest

consumer study cover 7000 respondents 21 products and services across 21 major cities. The

study, initiated by Awaaz Indias first dedicated Consumer Channel and member of the

worldwide CNBC Network, & AC Nielsen ORG Marg, was aimed at understanding the brand

preferences of the consumers & to decipher what are the most important loyalty criteria for the

consumer in each vertical.

The reasons behind the preferences for brands were unveiled by examining the following:

Tangible features of product / service.

Softer, intangible features like imagery, equity driving preference.

Tactical measures such as promotional / pricing schemes.

Sharekhan completes 12 years in Retail Broking Business

Sharekhan Ltd, Indias leading online retail broking house with a strong online trading platform,

has completed a decade in the business offering services such as portfolio management, trade

execution in equities, futures & options, commodities and distribution of mutual funds, insurance

and structured products.

In a short span of 12 years, the company has scripted

a remarkable growth story. Starting from beginningsin 8 th February 2000 as an online trading portal,

Sharekhan today has a pan-India presence as well as

global footprint in UAE and Oman with over 1,200

outlets serving 9,50,0000 customers across 400

cities.

Mr. Tarun Shah, CEO, Sharekhan, Says - We are

proud to be completing a decade of setting new

standards in the industry. This journey has been

eventful. And the journey couldnt have been such a

rewarding one without the support of our patrons who infused immense faith in our services in

the last 10 years. We profusely thank our patrons for the same.

-

8/13/2019 Str Final Project1(02)

25/72

Page25

Sharekhan in its decade-old journey has set category leadership through pioneering initiatives

like Trade Tiger; a net based executable application that emulates a broker terminal besides

providing information and tools relevant to traders. Through its First Step program Sharekhan

has been guiding first-time investors and helping them makes informed decisions.

ABOUT SHAREKHAN

1. SSKI named its online division as SHAREKHAN and it is into retail broking.

2. The business of the company overhauled 10 years ago on February 8, 2000.

3. It acts as a discount brokerage house to a full service investment solutions provider.

4. It has specialized research product for the small investors and day traders.

5. Largest chain of 640 shares shops in 280 cities across India.

6. The site was also launched on February 8, 2000 and named it as www.sharekhan.com .

7. Speed Trade account of Sharekhan is the next generation technology product launched on

April 17, 2002.

8. It offers its customers with the trade execution facilities on the

9. NSE and BSE, for cash as well as derivatives, depository services.

10. Ensures convenience in Trading Experience: Sharekhans trading services are designed to

offer an easy, hassle free trading experience, whether trading is done daily or

occasionally. Sharekhan providing the customers with a multi-channel access to the stockmarkets.

11. It gives advice based on extensive research to its customers and provides them with

relevant and updated information to help him make informed about his investment

decisions.

12. Sharekhan offers its customers the convenience of a broker-DP.

13. It helps the customers meet his pay in obligations on time thereby reducing the possibility

of auctions. And execute the instruction immediately on receiving it and thereafter the

customer can view his updated account statement on Internet.

14. Sharekhan depository services offer Demat services to individual and corporate investors.

A customer can avail of Demat, repurchase and transmission facilities at any of the

Sharekhan branches and business partners outlets.

http://www.sharekhan.com/http://www.sharekhan.com/http://www.sharekhan.com/http://www.sharekhan.com/ -

8/13/2019 Str Final Project1(02)

26/72

-

8/13/2019 Str Final Project1(02)

27/72

Page27

CHAPTER-4

PRODUCTS AND

SERVICES

-

8/13/2019 Str Final Project1(02)

28/72

Page28

PRODUCTS

The different financial products available in the company are as follows,

SMART TRADE PRODUCT:

This is a trading product where Sharekhan's experts aggressively scan the market for short-term

opportunities. It consists of fundamentally sound stocks that are expected to move sharply within

few days. These stocks may be held for a maximum of one month. We at Advise line will be in

constant touch with you via Recorded Messages, SMS and Yahoo Chat and keep you updated on

the status of the calls. The recommended initial margin for the Smart Trades Product is of

Rs.100000

HAMMOCK:

This Basket would consist of around 12 stocks handpicked by team of experts from Sharekhan's

Stock Ideas and is reviewed once a month. Stocks in this basket are generally held between 1

month and 1 year. Client will be receiving a Recorded Message, Email and SMS for all updates.

Company will review your portfolio during the month for any churn required. The recommended

initial capital* for this basket is Rs.120000''

SMART CHART:

Smart Charts is a medium term trading product where Sharekhan's highly experienced Technical

Research team recommends positional calls for a time frame of 1 - 2 months and covers the

whole gamut of liquid stocks available on the bourses. The recommendation can be on both buyas well as sell side, depending on the market scenario helping client to earn maximum returns

irrespective of the trend. These recommendations would be along with a target and a stop loss.

-

8/13/2019 Str Final Project1(02)

29/72

Page29

DELIVERY IDEAS:

This is an aggressive basket of fundamentally sound stocks, which are expected to move within a

time span of one month. Client will be given a fresh basket of stocks which will be booked

during the month based on opportunities. The stocks have an upside potential of 10 - 15% and a

downside risk of 6 - 7%. Client will receive a minimum of 6 series per annum. In order to invest

and earn optimum returns in this product company recommend an investment of Rs.100000.

Client will have to invest this amount equally in each of the stocks in the basket in equal

proportion.

-

8/13/2019 Str Final Project1(02)

30/72

Page30

SERVICES

Core Services of Sharekhan

As a Sharekhan customer you can decide the channel through which you want to receive

different Services.

-

8/13/2019 Str Final Project1(02)

31/72

Page31

OTHER SERVICES PROVIDED BY SHAREKHAN

Online Services:

Online BSE and NSE executions

Mutual Funds

Commodity Futures

PMS (Portfolio Management Services)

Technical PMS

Demat Services

Share Shop

Offline Services:

Trading with the help of Dealer

Trading without credit

By calling to the Share shops

Credit facility (Only in Delivery-based)

Special website for Offline Clients: www.mysharekhan.com

Physical contract note

-

8/13/2019 Str Final Project1(02)

32/72

-

8/13/2019 Str Final Project1(02)

33/72

Page33

Investing Online is so much easier!

In Classic accounts, it is very simple to do trading. Here customer has first

to open a Demat account with Sharekhan and after opening an account he

can get the login ID and password. With the help of login ID and password,

the client can login to the Sharekhan.com and in the classic a/c whatever

companys information the clients wants, he has to type the companys

name or code and he will get all the necessary information about thatcompany and he can buy or sell the that companys stock or shares. But,

here in the classical account the client can access only on one scrip at a

time.

Features of Classic Account:

Classic account enables you to buy and sell shares through our website. You get features like

Online trading account for investing in Equities and Derivatives via sharekhan.com

Integration of: Online trading + Bank + Demat account

Instant cash transfer facility against purchase & sale of shares

Make IPO bookings

You get Instant order and trade confirmations by e-mail

Single screen interface for cash and derivatives

-

8/13/2019 Str Final Project1(02)

34/72

Page34

Earlier it was known as Speed Trade and now it is known as Tiger

Trade.

This account is same as fast trade account. But, difference between

these two accounts is that in the Tiger Trade Account the client can

access more than 25 scripts at a time and buy and sell the share from

wherever they wants. This account also provides the charts and graphs,

so that the clients can easily understand about the stock of the

company. This is only for big clients and dealer kind of customers. This account is mainly for

active traders who trade frequently during the trading session. User-defined alert settings on an

input Stock Price trigger

Features of Trade Tiger Account: -

A single platform for multiple exchange BSE & NSE, MCX, NCDEX, Mutual Funds,

IPOs

Multiple Market Watch available on Single Screen Multiple Charts with Tick by Tick Intraday and End of Day Charting powered with

various Studies

Apply studies such as Vertical, Horizontal & Free lines User can save his own defined screen as well as graph template, that is, saving the layout

for future use

User-defined alert settings on an input Stock Price trigger

Shortcut key for FAST access to order placements & reports Online fund transfer activated with 12 Banks

-

8/13/2019 Str Final Project1(02)

35/72

Page35

Features of Dial-n-trade:

TWO dedicated numbers for placing your orders with your cell phone or landline. Toll free

number: 1-800-22-7050. For people with difficulty in accessing the toll-free number, we also

have a Reliance number (Your Local STD Code) 30307600 which is charged at as a local call.

Simple and Secure Interactive Voice Response based system for authentication No waiting time. Enter your TPIN to be transferred to our telebrokers

You also get the trusted, professional advice of our telebrokers

After hours order placement facility between 9.00 am and 9.30 am (timings to be extended

soon)

Offline Account: -

This is simple way to do trading. In the offline account, the client can place the order by

telephone or through personal visit in the office. The client who is very busy in their jobs or

business, they can directly place the order by the telephone or the client who are not much busy;

they can come to the office of Sharekhan.

Sharekhan also provide the Dial-n-trade service to their customers. So that customers can

directly place the order by the telephone.

Trading in Commodity Futures:

It provides with facility to trade in commodities (Bullion: Gold, silver and agricultural

commodities) through a wholly owned subsidiary of its Parent SSKI.

Sharekhan is a member of 2 Commodity Exchanges and offers trading facility at both these

exchanges:

-

8/13/2019 Str Final Project1(02)

36/72

Page36

Multi Commodity Exchange Of India (MCX) National Commodity And Derivative Exchange, Mumbai (NCDEX)

Software (Technology) Used In Sharekhan:

Sharekhan is using different technology for the running of their daily transactions.

Mainly for the trading, the company using three software.

Trade Tiger (WEB Based) Classic/Fast Trade (WEB Based)

PORTFOLIO MANAGEMENT

Portfolio management service (PMS) is a type of professional service offered by portfolio

managers to their client to help them in managing their money in less time. Portfolio managers

manage the stocks, bonds, and mutual funds of clients considering their personal investment

goals and risk preferences. In addition to money, the portfolio managers manage the portfolio of

stocks, bonds, and mutual funds.

Sharekhan ltd offers two types of Portfolio management services as follows, PMS Pro prime PMS Protech

PMS Pro prime:

The product details of pro prime are as follows Minimum Investment: Rs 5 lakhs. Lock in period: 6 Months. Reporting: Online access to portfolio holdings, quarterly reporting of portfolio

holdings/transactions.

-

8/13/2019 Str Final Project1(02)

37/72

Page37

Charges: 2.5% per annum AMC charged every quarter, 0.5% brokerage 20% profit

sharing after 15% hurdle is crossed-chargeable at the end of the fiscal year.

Profit withdrawal in multiples of 25000 after lock in period.

PMS Protech:

Protech uses the knowledge of technical analysis and the power of derivatives market to identify

trading opportunities in the market. The Protech lines of products are designed around various

risk/reward/volatility profiles for different kinds of investment needs.

The product details of Protech are as follows,

Minimum Investment: Rs 5 lakhs. Lock in period: 6 Months. AMC fees: 0% Reporting: Monthly reporting of transactions, brokerage 0.05% for derivatives, and 20%

profit sharing on booked profits on quarterly basis.

Profit withdrawal in multiples of 25000 after lock in period.

ADVISE LINE:With Advise line one does not have to tune into the news or search through endless pages of

reports to know about the market movements or to decide on which are the best stock

investments to make. They continually keep you updated on the global and local market

conditions. Clients are also, specially advised on the portfolio you build through Sharekhan.

-

8/13/2019 Str Final Project1(02)

38/72

Page38

DEMAT ACCOUNT

Dematerialization and trading in the Demat mode is the safer and faster alternative to the

physical existence of securities. Demat as a parallel solution offers freedom from delays, thefts,

forgeries, settlement risks and paper work. This system works through depository participants

(DPs) who offer Demat services and the securities are held in the electronic form for the

investor directly by the Depository.

Sharekhan Depository Services offers dematerialization services to individual and corporate

investors. They have a team of professionals and the latest technological expertise dedicated

exclusively to their Demat department, apart from a national network of franchisee, making

their services quick, convenient and efficient.

At Sharekhan, their commitment is to provide a complete Demat solution which is simple, safe

and secure.

-

8/13/2019 Str Final Project1(02)

39/72

Page39

Demat Account Opening & Brokerage Charges:

-

Fee structure for General Individual:

Charges Classic Account Trade Tiger Account

Account Opening Charges Rs. 750/- Rs. 1000/-

Brokerage Intra-day : 0.10 %

Delivery : 0.50 %

Intra-day : 0.10 %

Delivery : 0.50 %

Annual Maintenance Charges Rs. NIL first year

Rs. 300/= p.a. from second year onwards

For Intra-day Trades:-

This is subject to a minimum brokerage of 5 paisa per share. This means that if the share priceyou trade in is Rs 50/- or less, a minimum brokerage of 5 paisa per share will be charged.

For Delivery Based Trades :-

This is subject to a minimum brokerage of 10 paisa per share. Minimum brokerage of 10 paisa

per share will be applicable when the share price is Rs 20/- or less.

-

8/13/2019 Str Final Project1(02)

40/72

Page40

Sharekhan launches Share Mobile, an exclusive live

streaming quotes and trading facility for its online

trading customers

Next time when you are on move, you need not worry

about your favorite stocks price movement. You can

carry stock market terminal with you anywhere anytime.

Have you ever missed an investment or an opportunity

to book profit / loss, just because you were on move?

Sharekhan brings your freedom of being Mobile. Yes, its so easy with Share Mobile to track

your favorite stocks price movement tick-by-tick.

How Share Mobile does empower you?

Live tick by tick stock price.

Latest News Headlines

Track your My Trade Portfolio investments

Live Research Fundamental & Trading Calls

Sharekhan Depository Services:

Sharekhan Depository Services offers dematerialization services to individual and corporate

investors. Sharekhan has a team of professionals and the latest technological expertise dedicated

exclusively to our Demat department, apart from a national network of franchisee, making the

services quick, convenient and efficient.

-

8/13/2019 Str Final Project1(02)

41/72

Page41

Trading in Commodity Futures:

It provides with facility to trade in commodities (Bullion: Gold, silver and agricultural

commodities) through a wholly owned subsidiary of its Parent SSKI.

Sharekhan is a member of 2 Commodity Exchanges and offers trading facility at both these

exchanges:

Multi Commodity Exchange Of India (MCX) National Commodity and Derivative Exchange, Mumbai (NCDEX)

Software (Technology) Used In Sharekhan:Sharekhan is using different technology for the running of their daily transactions.

Mainly for the trading, the company using three software.

ODIN (VSAT Based) Trade Tiger (WEB Based) Classic/Fast Trade (WEB Based)

And also NEAT System Used for making transaction in NSE listed company & same way BOLT

System Used for making transaction BSE listed company.

And for the client information or customer service, the company using two software. CIS Client Information System. BOC Back Office.

-

8/13/2019 Str Final Project1(02)

42/72

Page42

CHAPTER-5

MARKET

OPPORTUNITIES

-

8/13/2019 Str Final Project1(02)

43/72

Page43

MARKETING STRATEGIES

The marketing strategy was mainly focused on reaching to every segment of people

SEGMENTATION:

Sharekhan segmented the whole market in to three types of clients which are as follows,

Retail investors High net worth investors Day traders (or) speculators

TARGETING

As most of clients are middle income people, Sharekhan targets mainly on retail investors such

as salaried people and middle income people.

PROMOTIONAL STRATEGIES

Telemarketing:

In the organization, database of contact numbers of various category of people are maintained

who may or may not know about the services.Sales executives and assistant managers make

phone calls to these people and if they are interested, give various details about the services and

products.This will make people to opt for Sharekhan in future even if they are not interested to

enter stock market currently.

Seminars:

The sales personnel of Sharekhan prepare seminars depending upon the type of people they are

going to meet ie students or coporate people.They go to respective institutions and take seminars

-

8/13/2019 Str Final Project1(02)

44/72

Page44

giving various details suiting that category people and the contact numbers of Sharekhan sales

personnel to contact further if interested.

Door steps:

The sales personnel also go to domestic homes of people and various institutions (meet every

person in person, not like seminars).They explain to them in detail, various schemes, products

and services. They also explain about the documents required to open an account with

Sharekhan. If the person is interested the sales personnel will acquire the documents and will

proceed further.

KIOSKS:

The sales team puts up stalls in various locations and provide pamphlets containing details aboutvarious products and services of Sharekhan. They also explain orally to people who are

interested.

Online advertising:

-Sharekhan has links to various websites through which they market their products and services

ie through pop up windows and flash texts which when clicked directly leads to

Sharekhans website .

Media :

Sharekhan also uses advertisements in TV channels like CNBC.

POSITIONING:

Positioning strategy adopted by Sharekhan is they associated themselves with technology.

Standardized procedures are the first thing that comes to mind of a client when he thinks of

Sharekha

-

8/13/2019 Str Final Project1(02)

45/72

Page45

Sharekhan provide right investment decision to Investors according to their

needs

-

8/13/2019 Str Final Project1(02)

46/72

Page46

Seven Reasons

Why Customers first choice is SHARAKHAN?

EXPERIENCE:

SSKI has more than eight decades of trust and Credibility in the Indian stock market. In the Asia

Money brokers poll held recently, Sharekhan won the India best broking house for 2004

award. Ever since it launched Sharekhan as its retail broking division in February 2000, it has

been providing institutional-level research & broking services to investors.

TECHNOLOGY:

With Sharekhan online trading account you can buy and sell shares in an instant from any PC

with an internet connection. You will get access to our powerful online trading tools that will

help you take complete control over your investment in shares.

KNOWLEDGE:

In a business where the right information at the right time can translate into direct profits, you

get access to a wide range of information on Sharekhans website www.sharekhan.com. You will

also get a useful set of Knowledge-based tools that will empower you to take informed decisions.

ACCESSIBILITY:

In addition to Sharekhan online and phone trading services also very useful. Sharekhan also

have a ground network of 640 share shops across 280 Cities in India where you can get

personalize Services.

CONVENIENCE:

You can call Sharekhans Dial -n-Trade number to get investment advice and execute your

transactions. Sharekhan have a dedicated Call Center to provide this service via a toll-free

number from anywhere in India.

-

8/13/2019 Str Final Project1(02)

47/72

Page47

CUSTOMER SERVICE:

Sharekhans customer service team will assist you for any help that you need relating to

transactions, billing, demat and other queries. Sharekhans customer service can be contacted via

a toll-free number-mail or live chat on Sharekhan.com.

INVESTMENT ADVICE:

Sharekhan has dedicated research teams for fundamental and technical research. Sharekhans

analysts constantly track the pulse of the market and provide timely investment advice to you in

form of daily research e-mail, online chat, printed reports and SMS on your phone.

-

8/13/2019 Str Final Project1(02)

48/72

Page48

SWOT ANALYSIS OF SHAREKHAN

STRENGTHS:

Online Trading Facility Largest Chain of Retail Share Shops in India 88 years of Experience in securities market Dedicated and responsive workforce/staff Value added service for HNI client Research Center Membership of NSE & BSE Trading option like Future & Option and Commodities Volume based differentiated product. Innovation of ideas Effective communication system Online growth Introduction of new software of better quality

WEAKNESSES;

Less informative website Does not have slab rate brokerage which is provided by competitors Problems due to network crash Unawareness Among Investors

OPPORTUNITY:

Collaboration with international financial institution To tap the Untapped market To capture the market lost to its Competitors. To focus on developing a superior and powerful portal To spread awareness of its Brand Name.

-

8/13/2019 Str Final Project1(02)

49/72

Page49

THREATS:

Follow government laws Competitors develops Prolonged depression and high volatility in the market New Entrants.

Awards & Achievements of SHAREKHAN:

2001 - Web Award winner of Chip magazines Best Financial

2004 - Best Local Brokerage by Advisory Poll of Poll 2004.

2005 - Awaaz Consumer Awards Best Broking House by CNBC channel.

Sharekhan is amongst top 3 online Brokers in India.

-

8/13/2019 Str Final Project1(02)

50/72

Page50

CHAPTER-6

DATA ANALYSIS

AND

INTERPRETATION

-

8/13/2019 Str Final Project1(02)

51/72

Page51

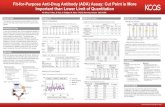

Q1. Where do you invest your savings?

OPTIONS NO OF RESPONDENTS

Equity 59

Mutual fund 25

Fixed deposits 9

Insurance 7

INTERPRETATIONS:

This figure says that most people go for at 1 st EQUITY investment then for MUTUAL

FUND, FIXED DEPOSITS AND INSURANCE. Because equity gives good return in

short time as well as long term as compared to mutual fund.

59

25

9 7

0

10

20

30

40

50

60

70

P e r c e n

t a g e

Sector

EQUITY

MUTUAL FUND

FIXED DEPOSITS

INSURANCE

-

8/13/2019 Str Final Project1(02)

52/72

Page52

Q2. Your investment decisions are influenced by

Options No of respondents

Oneself 24

Broker 36

Eco policies 20

Market research 12

Friends/relatives 8

Any other 0

INTERPRETATIONS:

How do investors take their investment decisions is presented in this bar graph. In this graph it is

evident that mostly investment decisions are taken on the insistence of the brokers firms and

companies and that percentage is 36%.

In this area Sharekhan has its own research report and that strike rate has 80%. This is an

advantage to the customers of Sharekhan.

24

36

20

8

0

5

10

15

20

25

30

35

40

P e r c e n

t a g e

Investment Decisions

Oneself

Brokers

Eco. Policies

Market Ramous

Friends/Relatives

-

8/13/2019 Str Final Project1(02)

53/72

Page53

Q3. Are you satisfied with your current investment?

OPTIONS NO OF RESPONENTSYES 42

NO 58

INTERPRETATIONS:

That chat is show the satisfaction level of current investment( in share) and long term

investment(mutual fund) than here shows that the satisfaction level in current investment (shares)is 58% and satisfaction in long term investment (mutual fund) is 42%.

42%

58%

Chart TitleYES NO

-

8/13/2019 Str Final Project1(02)

54/72

Page54

Q4. What is the factors which you considered before investing in particular

company?

OPTIONS NO OF RESPONDENTS

Financial potions 24

Current market position 36

Goodwill 20

Future prospects 12

Any other 08

INTERPRETATIONS:

It is evident that in the current market position accounts for 36%, most investors go forinvestment after seeing the current market positions and after that the financial position of

company which is at 24%, then goodwill of company at 20%, future prospects at 12%,and any

other factors at 8%.

24

36

20

12

8

0

5

10

15

20

25

30

35

40

P e r c e n

t a g e

factors

Financial Positions

Current marketPositions

Goodwill

Future Prospects

Any other

-

8/13/2019 Str Final Project1(02)

55/72

Page55

Q5. What is the basic purpose of your Investments?

OPTIONS NO OF RESPONDENTSLiquidity 30

Return 25

Capital Appreciation 10

Tax Benefits 20

Risk Covering 5

Others 10

INTERPRETATION

As with the above analysis, it is found 75% people are interested in liquidity, returns and tax

benefits. And remaining 25% are interested in capital appreciations, risk covering, and others. In

the entire respondent it is common that this time everyone is looking for minimizing the risk and

maximizing their profit with the short time of period.

As explaining them About the Portfolio Management Services of Share khan, they were quite

interested in Protech Services.

0%10% 20%

30%

Liqidity

Return

Capital Appreciation

Tax Benefits

Risk Covering

Others

%AGE

-

8/13/2019 Str Final Project1(02)

56/72

Page56

Q6. What is the most important factor you consider at the time of

Investment?

OPTIONS NO OF RESPONENTS

RISK 12

RETURN 23

BOTH 65

INTERPRETATION

As the above analysis gives the clear idea that most of the Investors considered the market factor

as around 12% for Risk and 23% Return, but most important common things in all are that they

are even ready for taking both Risk and Return in around 65% investor.

Moreover, the Market is fluctuating now days, so as it also getting improvement. So, Investor are

looking for Investment in long term and Short-term.

0%

20%

40%

60%

80%

RiskReturn

Both

12% 23%

65%

%AGE

-

8/13/2019 Str Final Project1(02)

57/72

Page57

Q7. From which option you will get the best returns?

OPTIONS NO OF RESPONDENTS

Others 2%

Property 14%

Bonds 8%

Fixed Deposits 18%

Commodities Market 16%

Shares 22%

Mutual Fund 20%

INTERPRETATION

Most of the respondents say they will get more returns in Share Market. Since Share Market issaid to be the best place to invest to get more returns. The risk in the investment is also high.

Similarly, the Investor are more Interested in Investing their money in Mutual Fund Schemes as

that is also very important financial product due to its nature of minimizing risk and

Mutual Funds

Shares

Commodities Market

Fixed Deposits

Bonds

Property

Others

20%

22%

16%

18%

8%

14%

2%

PERCENATGE OF RESPODENTS

-

8/13/2019 Str Final Project1(02)

58/72

Page58

maximizing the profit. As the commodities market is doing well from last few months so

Investor also prefer to invest their money in Commodities Market basically in GOLD nowadays.

Moreover, even who dont want to take Risk they are looking for investing in Fixed Deposit for

long period of time.

Q8. Investing in PMS is far safer than Investing in Mutual Fund. Do you

agree?

INTERPRETATION

In the above graphs its clear that 24% of respondent out of hundred feel that investing their

money in Mutual Fund Scheme are far safer than Investing in PMS. This is because of lack of

proper information about the Portfolio management services. As the basis is same for the mutual

fund and PMS but the investment pattern is totally different from each other and which depends

upon different risk factor available in both the Financial Products.

0%

50%

100%

YesNo

76%

24%

Yes No%Age of Respodents 76% 24%

-

8/13/2019 Str Final Project1(02)

59/72

Page59

Q9. How much you carry the expectation in Rise of your Income from

Investments?

OPTIONS NO. OF RESPODENTS

UPTO 15% 48%

15-25% 32%

25-35% 12%

MORE THAN 35% 8%

INTERPRETATION

The optimism is shown in the attitude of the respondents. The confidence was appreciable with

which they are looking forward to a rise in their investments. Major part of the sample feels that

the rise would be of around 15%. Only 8% of the respondents were confident enough to expect a

rise of up to 35%.

As all the respondents were considering the Risk factor also before filling the questionnaire and

they were asking about the performance report of all the PMS services offered by Share khan

limited.

UPTO 15%

15-25%

25-35%

Morethan35%

48%32%

12%8%

-

8/13/2019 Str Final Project1(02)

60/72

Page60

Q10. If you invested in Share Market, what has been your experience?

INTERPRETATION

20% of the respondents have invested in Share market and received satisfactory returns, 40% of

the respondents have not at all invested in Share Market. Some of the investors face problems

due to less knowledge abou t the market. Some of the respondents dont have complete overview

of the happenings and invest their money in wrong shares which result in Loss. This is the reason

most of the respondents prefer Portfolio Management Services to trade now a days, which gives

the Investor the clear idea when is the right time to buy and right time to sell the shares which is

recommended by their Fund Manger.

%Age of Respondents

0%

20%

40%

Satisfactoryreturn received Burned Fingers Unsatisfactory

results No

20%34%

6%

40%

Satisfactory return

received

Burned FingersUnsatisfactory

results

No

%Age of Respondents 20% 34% 6% 40%

-

8/13/2019 Str Final Project1(02)

61/72

Page61

Q11. If you trade with Share khan limited then why?

INTERPRETATION

As the above research shows the reasons and the parameters on which investor lie on Share khan

and they do the trade.

Among hundred respondents 35% respondents do the trade with the company due to its research

Report, 28% based on Brokerage Rate whereas 22 % are happy with its Services.

Last but not the least, 15% respondents are depends upon the tips of Share khan which gives

them idea where to invest and when to invest.At the time of research what I found is that still Share khan need to make the clients more

knowledge about their PMS product.

Services22%

InvestmentTips are good

15%Brokerage28%

Research35%

-

8/13/2019 Str Final Project1(02)

62/72

Page62

Q12. Are you using Portfolio Management services (PMS) of Share khan?

OPTIONS NO. OF RESPODENT

YES 56% NO 44%

INTERPRETATION

As talking about the Investment option, in most of clients it was common that they know about

the Option but as the PMS of Share khan have different Product offering, Product Characteristics

and the Investment amount is also different this makes the clients to think differently.

It is found that 56% of Share khan client where using PMS services as for their Investment

Option.

Yes56%

No

44%

-

8/13/2019 Str Final Project1(02)

63/72

Page63

Q13. How was your experience about Portfolio Management services (PMS) of Share khan

Limited?

INTERPRETATIONIn the above analysis it is clear that the Investor have the good and the bad experience both with

the Share khan PMS services.

In this current scenario 52% of the Investor earned, whereas around 18% have to suffer losses in

the market. Similarly 30% of the Respondents are there in Breakeven Point (BEP), where no loss

and no profit.

0% 10% 20% 30% 40% 50% 60%

Earned

Faced Loss

No Profit No Loss Situation

Earned Faced LossNo Profit No Loss

Situation%Age of Respondents 52% 18% 30%

-

8/13/2019 Str Final Project1(02)

64/72

Page64

Q14. Do you recommend Share khan PMS to others?

OPTIONS NO. OF RESPODENT

YES 86% NO 14%

INTERPRETATION

The above analysis shows the Investor perception toward the Share khan PMS as on the basis of

their good and bad experience with Share khan limited. Among hundred respondents 86%

respondents were agree to recommend the PMS of Share khan to their peers, relatives etc.

Yes86%

No14%

-

8/13/2019 Str Final Project1(02)

65/72

Page65

FINDINGS

1. There has been considerable increase in investment in mutual funds, because in mutual

fund investment they can diversify their risk into the various sectors.

2. Investment in large cap company is always having less risk, followed by mid cap and

small cap companiesand in small cap companies there is high risk and high returns.

3. It has been found that most of the people go for taking investment decision from the share

broker without knowing about company

4. Most of the people invest in share market mainly because of two reasons viz- investment

in share market gives high liquidity and high return.

5. Most of the investor doesnt know abo ut fundamental and technical analysis.

6. Awareness about the Equity market is very less in the people.

-

8/13/2019 Str Final Project1(02)

66/72

-

8/13/2019 Str Final Project1(02)

67/72

Page67

LIMITATIONS

1. The research is confined to a certain parts of Delhi and does not necessarily shows a

pattern applicable to all of Country.

2. Some respondents were reluctant to divulge personal information which can affect the

validity of all responses.

3. In a rapidly changing industry, analysis on one day or in one segment can change very

quickly. The environmental changes are vital to be considered in order to assimilate the

findings.

-

8/13/2019 Str Final Project1(02)

68/72

Page68

RECOMMENDATION

1. MORE BRANCHES

Need to open more branches to be a topper in market because it has a

low distribution network.

2. LESS TIME

They should try to make some arrangements to reduce account opening

time by verifying documents at branch it selves.

3. LINK-BANK A/Cs

Linked as many accounts as client wants to its online account.

4. NEW BANKS IN THE KITTY

Need to tie up with major banks like SBI, Allahabad Bank, Bank of Baroda etc.

5. CUSTOMER SATISFACTIONThe company should focus on the customer satisfaction not on just taking money from their

pocket.

6. CONTROLLED BRANCHES

The company would have to make some arrangements to control the branches and make

standardized procedures for all of them for their better control and performance appraisal.

Commitment should be equalized for every person. Provide the facility of free demonstrations for all. Improvement in the opening of De-mat & contract notice procedure is required.

-

8/13/2019 Str Final Project1(02)

69/72

Page69

BIBLOGRAPHY

BOOKS/MAGAZINES

Gordon & Natrajan, Financial Markets And Services Second Revised Edition Reprint,Himalaya Publishing House, 2005.

AVADHANI V.A. Investment Management Business Times India Today

WEBSITES

http://www.moneycontrol.com/stocksmarketsindia/ http://www.sharekhan.com/stock-market/11/home.htm http://www.nseindia.com/live_market/dynaContent/live_market.htm

NEWS PAPER

ECONOMICS TIMES TIMES OF INDIA

OTHERS

Sharekhans Broachers NCFM Capital Market Dealers Module Other Magazines for Capitals Markets

http://www.moneycontrol.com/stocksmarketsindia/http://www.moneycontrol.com/stocksmarketsindia/http://www.sharekhan.com/stock-market/11/home.htmhttp://www.sharekhan.com/stock-market/11/home.htmhttp://www.nseindia.com/live_market/dynaContent/live_market.htmhttp://www.nseindia.com/live_market/dynaContent/live_market.htmhttp://www.nseindia.com/live_market/dynaContent/live_market.htmhttp://www.sharekhan.com/stock-market/11/home.htmhttp://www.moneycontrol.com/stocksmarketsindia/ -

8/13/2019 Str Final Project1(02)

70/72

Page70

ANNEXURE

Q1Where do you invest your savings?

Equity

Mutual Fund

Fixed Deposite

Insurance

Q2. Your investment decisions are influenced by

Oneself

Broker

Eco policies

Market research

Friends/relatives

Any other

Q3. Are you satisfied with your current investment?

Yes

No

Q4. What is the factors which you considered before investing in particular company?

Financial potions

Current market position

Goodwill

Future prospects

Any other

-

8/13/2019 Str Final Project1(02)

71/72

Page71

Q5. What is the basic purpose of your Investments?

Liquidity

Return

Capital Appreciation

Tax Benefits

Risk Covering

Others

Q6. What is the most important factor you consider at the time of Investment?RISK

RETURN

BOTH

Q7. From which option you will get the best returns?

Others

Property

Bonds

Fixed Deposits

Commodities Market

Shares

Mutual Fund

Q8. Investing in PMS is far safer than Investing in Mutual Fund. Do you agree?

Yes

No

Q9. How much you carry the expectation in Rise of your Income from Investments?

UPTO 15%

-

8/13/2019 Str Final Project1(02)

72/72

15-25%

25-35%

MORE THAN 35%

Q10. If you invested in Share Market, what has been your experience?

Satisfactory Return Received

Burned Fingers

Unsatisfactory Results

No

Q11. If you trade with Share khan limited then why?

Research

ServicesBrokerage

Investment Tips Are Good

Q12. Are you using Portfolio Management services (PMS) of Share khan?

Yes

No

Q13. How was your experience about Portfolio Management services (PMS) of Share khan

Limited?

Earned

Faced Loss

No Profit No Loss

Q14. Do you recommend Share khan PMS to others?

Yes